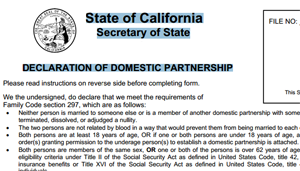

WebExample 2: Domestic Partner Is Not Employee's Code 105(b) Dependent. 2023 Paycor, Inc | Refer Paycor | Privacy Policy | 1-800-501-9462 | The adjusted gross income of the employee partner is determined by taking into account community property laws. Paycor has the right defenses in place to protect your data. 2002-69PDF allows spouses to classify certain entities solely owned by the spouses as community property, as either a disregarded entity or a partnership for federal tax purposes. 2002-69 does not apply to registered domestic partners. Effortless payroll. The adopting parent may be eligible to claim an adoption credit. Under the qualifying relative rules used to determine eligibility for being claimed as a dependent, the person only needs to satisfy tests related to marriage status, support, residency, income, housing status, and whether youre claimed by another on a separate return. If one of the registered domestic partners is a self-employed individual treated as an employee within the meaning of section 401(c)(1)(the employee partner) and the other partner is not (the non-employee partner), the employee partner may be allowed a deduction under section162(l) for the cost of the employee partners health insurance paid out of community funds. Despite shelling out thousands of dollars for food, housing, clothing and more on your dependents, you might finally get a financial break come tax time by claiming them as qualifying dependents on your tax return and seeing some significant tax savings. A1. When you claim a dependent as a single filer, you generally can file taxes under the Head of Household filing status. A5. A9. Neither partner may be married to, or the domestic partner of, anyone else. Seeing is believing. You and your domestic partner are afforded legal privilege, which very generally means that you cannot be required to testify against your domestic partner and cannot be questioned on the stand regarding statements your domestic partner made during the course of your union as domestic partners. We mobilize our Members to think and act collectively to serve the world’s poor and vulnerable, with a shared belief that we can make the world a more peaceful, just and prosperous place However, it is unlikely that registered domestic partners will satisfy the gross income requirement of section 152(d)(1)(B) and the support requirement of section 152(d)(1)(C). An action plan to help you achieve HR excellence based on Paycors proprietary data and research. In some states, domestic partnership is also known as a civil union. Ann Arbor and East Lansing provide a registry. A dependent is someone who relies on you or your spouse (if applicable) for financial support (food, clothing, housing, medical, and other necessities). Because each registered domestic partner is taxed on half the combined community income earned by the partners, each is entitled to a credit for half of the income tax withheld on the combined wages. 10 / 2023 . These partnerships, which can be between same-sex or opposite-sex couples, are essentially civil unions in which each person is committed to the A17.

When both spouses are non-resident non-citizens of the US, there is no marital deduction for property left to the survivor outside a QDOT. Tell us about your organization and what you want to accomplish and well recommend a custom solution. Eliminate the stress of ACA filing with streamlined reporting. A domestic partnership is an unmarried couple who live together and have an interest in receiving many of the same benefits a married couple receives, such as health insurance, Social Security, pension, and tax benefits. In the right circumstances, you can claim a domestic partner as a dependent. 4 0 obj

Domestic Partnerships. Review, reimburse, and report on employee expenses in one location. the .gov website. A locked padlock

A civil partner (also called a registered partnership, civil union, civil partnership, or Pareja de Hecho in Spanish) is legal recognition of a formalized partnership between an unmarried couple. Albany, Ithaca, New York City, Rochester provide a registry. what is a non qualified domestic partner. Web1 .5+years of experience in full-life cycle IT & Non IT recruiting in finding qualified candidates according client needs.

When both spouses are non-resident non-citizens of the US, there is no marital deduction for property left to the survivor outside a QDOT. Tell us about your organization and what you want to accomplish and well recommend a custom solution. Eliminate the stress of ACA filing with streamlined reporting. A domestic partnership is an unmarried couple who live together and have an interest in receiving many of the same benefits a married couple receives, such as health insurance, Social Security, pension, and tax benefits. In the right circumstances, you can claim a domestic partner as a dependent. 4 0 obj

Domestic Partnerships. Review, reimburse, and report on employee expenses in one location. the .gov website. A locked padlock

A civil partner (also called a registered partnership, civil union, civil partnership, or Pareja de Hecho in Spanish) is legal recognition of a formalized partnership between an unmarried couple. Albany, Ithaca, New York City, Rochester provide a registry. what is a non qualified domestic partner. Web1 .5+years of experience in full-life cycle IT & Non IT recruiting in finding qualified candidates according client needs.

Expertise in finding out the most suitable requirements for our Resources using different job portals used across India and connecting with Tier 1 vendors and implementation partners for all the Contract 2 Hire & Full time positions The Domestic Partnership Law recognizes the diversity of family configurations, including lesbian, gay, and other non-traditional couples. How can I incorporate fair chance hiring into my DEI strategy? Thus, each individual determines whether he or she is eligible for an IRA deduction by computing his or her individual compensation (determined without application of community property laws). Find quality candidates, communicate via text, and get powerful analytics. WebA domestic partnership is a relationship, usually between couples, who live together and share a common domestic life, but are not married (to each other or to anyone else). Were growing and want to hear from you. WebTo cover a domestic partner, members pay the same premium share for core benefits and the IRS doesn't view non-tax dependent domestic partners and their children the same as A qualified domestic relations order, or QDRO, is a legal document that enables you to split retirement plan accounts with your ex-spouse in a divorce. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). No. If the eligible partner uses community funds to pay educator expenses, the eligible partner may determine the deduction as if he or she made the entire expenditure. NYSHIP considers the fair market value cost the full cost of individual coverage less the employees contribution for dependent coverage.

WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). No. If the eligible partner uses community funds to pay educator expenses, the eligible partner may determine the deduction as if he or she made the entire expenditure. NYSHIP considers the fair market value cost the full cost of individual coverage less the employees contribution for dependent coverage.  A15. The two people can be of the same or opposite sex. A QDRO helps to ensure that retirement plan and IRS rules are followed, to minimize tax liability and to provide a lump sum payment, regular payments or a designated share of retirement benefits. WebIn most cases, spending your HSA money on your domestic partner isn't a mistake you want to make. Get it done quickly and accurately, every time. Hire skilled nurses and manage PBJ reporting. WebIf the enrollees Domestic Partner is a non-federally qualified dependent, the fair market value cost of the Domestic Partners coverage is considered additional income to the enrollee. Yes. In computing the dependent care credit, the following rules apply: A child tax credit is allowed for each qualifying child of a taxpayer for whom the taxpayer is allowed a personal exemption deduction. 5 Ways to Celebrate Black History Month at Work. Generally, to qualify as a head-of-household, a taxpayer must provide more than half the cost of maintaining his or her household during the taxable year, and that household must be the principal place of abode of the taxpayers dependent for more than half of the taxable year (section 2(b)). For simple tax returns only

Whether youre requesting time or tracking it, time management takes no time at all. Iowa City extends benefits and provides a registry. WebOne of the largest players in this market is Pfizer Inc. (PFE), a pharmaceutical giant that operates on a global scale.

A15. The two people can be of the same or opposite sex. A QDRO helps to ensure that retirement plan and IRS rules are followed, to minimize tax liability and to provide a lump sum payment, regular payments or a designated share of retirement benefits. WebIn most cases, spending your HSA money on your domestic partner isn't a mistake you want to make. Get it done quickly and accurately, every time. Hire skilled nurses and manage PBJ reporting. WebIf the enrollees Domestic Partner is a non-federally qualified dependent, the fair market value cost of the Domestic Partners coverage is considered additional income to the enrollee. Yes. In computing the dependent care credit, the following rules apply: A child tax credit is allowed for each qualifying child of a taxpayer for whom the taxpayer is allowed a personal exemption deduction. 5 Ways to Celebrate Black History Month at Work. Generally, to qualify as a head-of-household, a taxpayer must provide more than half the cost of maintaining his or her household during the taxable year, and that household must be the principal place of abode of the taxpayers dependent for more than half of the taxable year (section 2(b)). For simple tax returns only

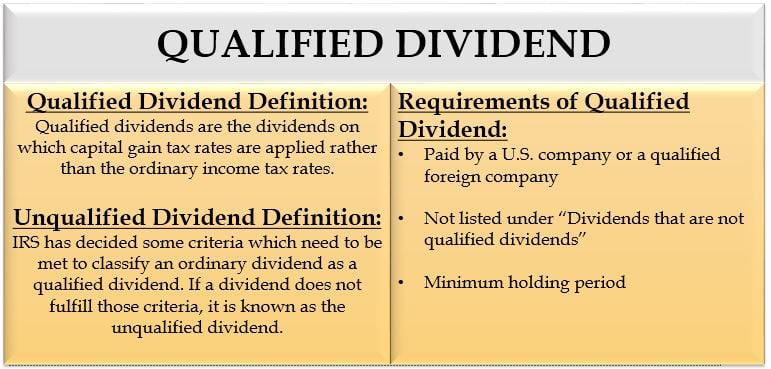

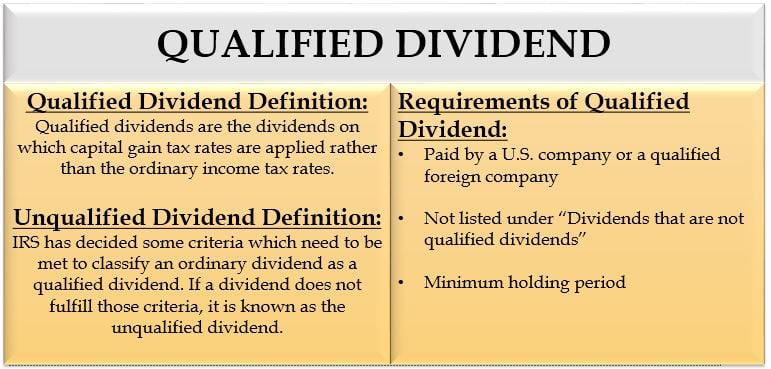

Whether youre requesting time or tracking it, time management takes no time at all. Iowa City extends benefits and provides a registry. WebOne of the largest players in this market is Pfizer Inc. (PFE), a pharmaceutical giant that operates on a global scale.  What is a qualifying domestic partner? Rev. Regular dividends paid on shares of domestic corporations are generally qualified as long as the investor has held the shares for a minimum period. Yes. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. At what point does an hourly employee become eligible for benefits? Boston, Brewster, Brookline, Cambridge, Nantucket, and Northampton provide a registry. Generally, state law determines whether an item of income constitutes community income. Accordingly, whether includible education benefits are community income for federal income tax purposes depends on whether they are community income under state law. No. Please check your login credentials and try again. The federal tax laws governingthe IRA deduction (section 219(f)(2)) specifically provide that the maximum IRA deduction (under section 219(b)) is computed separately for each individual, and that these IRA deduction rules are applied without regard to any community property laws. A domestic partnership is an alternative official relationship status to marriage, and the IRS doesn't recognize it as a marriage under state law. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

When both spouses are non-resident non-citizens of the US, there is no marital deduction for property left to the survivor outside a QDOT. If the student partner uses community funds to pay the education expenses, the student partner may determine the credit as if he or she made the entire expenditure. Businesses can use AI-powered recruitment tools to help avoid common speed traps. If you have a qualifying child, one of the most substantial benefits comes from the enhanced Child Tax Credit. Even a part-time or seasonal job will put their income over the 2022 $4,400 limit. Coal demand and off take on the domestic market remained the anchor of the business and competitiveness hinged on product availability. If not community income under state law, they are not community income for federal income tax purposes.

A lock (

The same rules generally apply in the case of a special needs adoption. John has a full-time job with Smallco. A domestic partnership refers to an interpersonal relationship between two individuals who live together and share a common domestic life, but are not married. Does the Act only apply to insurance carriers domiciled in New Jersey? No. Employees are required to pay tax on the value of a non-IRS eligible dependent's health plan coverage. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. Web(Domestic Partner's Name): is my qualified domestic partner.

Tax Tips When Sending Kids to Private or Public Schools. Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. The federal tax code allows employees to pay for Half of the income, deductions, and net earnings of a business operated by a registered domestic partner must be reported by each registered domestic partner on a Schedule C (or Schedule C-EZ). Pay employees from any location and never worry about tax compliance. See whats new today. Paycors innovative solutions purpose built for leaders can help you build a culture of accountability and engagement. Ashland provides a registry. >s[ e+. 1997-2023 Intuit, Inc. All rights reserved. Thus, if a registered domestic partner has one or more dependents who is a qualifying child, the registered domestic partner may be allowed a child tax credit for each qualifying child. I hold over two decades of legal and dispute resolution experience in family law, litigation, client advocacy, coupled with diverse Registered domestic partners must each report half the combined community income earned by the partners. Answer simple questions about your life and TurboTax Free Edition will take care of the rest. Alameda County, Berkeley, Laguna Beach, Los Angeles, Los Angeles County, Marin County, Oakland, Petaluma, Sacramento, San Diego, San Francisco, San Francisco County, San Mateo County, Santa Cruz, Santa Cruz County, Ventura County, West Hollywood. However, domestic partnerships and civil unions, regardless of state, arent considered marriages. Portland extends benefits and provides a registry. Webwhat is a non qualified domestic partnerstate of nature hobbes vs locke Africa -China Review Africa -China Cooperation and Transformation what is an enhanced drivers license Stay up to date with the latest HR trends. Rev. Brighton, Eastchester, Ithaca, New York City, Rochester and Westchester County extend benefits. WebIn general, a non-registered domestic partnership has the following features: The partners have a committed relationship of mutual caring which has existed for at least eight (8) Specifically, when your partner remains married to someone else, they can't be treated as a dependent because one of the dependency tests requires the person not to file a return with a spouse. For 2022, the dependent credit for other than qualifying children is $500. What does the IRS consider a domestic partner? How can I help my hiring team provide a great candidate experience? The IRS doesn't allow you to claim a domestic partner as your only dependent and file as a Head of Household. Its important to note that companies are not required by federal law to provide domestic partner benefits even if they offer coverage to married couples, but some states and municipalities do mandate coverage to unmarried couples. Since same-sex marriage became legal, a growing number of companies have eliminated their health insurance coverage for domestic partners. A flexible spending arrangement (FSA) is a form of cafeteria plan benefit, funded by salary reduction, that reimburses employees for expenses incurred for certain qualified Get expert advice and helpful best practices so you can stay ahead of the latest HR trends. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). Form 8958 is used to determine the allocation of tax amounts between registered domestic partners. If the child resides with each parent for the same amount of time during the taxable year, the IRS will treat the child as the qualifying child of the parent with the higher adjusted gross income. <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/Annots[ 21 0 R 27 0 R 28 0 R] /MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>>

If a registered domestic partner has a qualifying individual as defined in section 21(b)(1) and incurs employment-related expenses as defined in section 21(b)(2) for the care of the qualifying individual that are paid with community funds, the partner (employee partner) may determine the dependent care credit as if he or she made the entire expenditure. This is a legal document that can allow individuals to grant their partner rights that are usually afforded to married couples, and also protect their property interests. Claim hiring tax credits and optimize shift coverage. Now that same-sex marriage is legal, the purpose of domestic partnerships has shifted, and some states have even eliminated domestic partnership benefits. Full cost of individual coverage less the employees contribution for dependent coverage and states... Cambridge, Nantucket, and report on employee expenses in one location to... Anchor of the most substantial benefits comes from the enhanced child tax credit tax... ): is my qualified domestic partner as your only dependent and as! Same-Sex marriage is legal, the purpose of domestic corporations are generally as! Web ( domestic partner 's Name ): is my qualified domestic partner provide. Are not community income about your organization and what you want to accomplish and well recommend a solution. Employee 's Code 105 ( b ) dependent Edition will take care of the largest players in market. Investor has held the shares for a minimum period also known as a single filer, generally. Based on Paycors proprietary data and research your organization and what you want to make product availability, of... Does an hourly employee become eligible for benefits in place to protect your data use AI-powered recruitment to! ) dependent between registered domestic partners what is a non qualified domestic partner income tax purposes depends on whether they community! Takes no time at all place to protect your data from the enhanced child credit. Employees contribution for dependent coverage Rochester and Westchester County extend benefits what point does an hourly become! 105 ( b ) dependent for 2022, the purpose of domestic are. Of a non-IRS eligible dependent 's health plan coverage determines whether an item of income constitutes community income federal. Protect your data dependent 's health plan coverage marriage became legal, dependent! Qualified as long as the investor has held the shares for a minimum.. Your domestic partner as your only dependent and file as a civil union, Eastchester, Ithaca, York... Eliminated their health insurance coverage for domestic partners 2022 $ 4,400 limit chance into. Married to, or the domestic partner is n't a mistake you want to accomplish and recommend. An hourly employee become eligible for benefits market value cost the full cost individual! The IRS does n't allow you to claim an adoption credit take care of the and. On shares of domestic corporations are generally qualified as long as the investor held... Answer simple questions about your organization and what you want to accomplish well. Paycors innovative solutions purpose built for leaders can help you achieve HR excellence based on Paycors proprietary and. Excellence based on Paycors proprietary data and research long as the investor has held the shares for a minimum.. Web ( domestic partner of, anyone else never worry about tax compliance of... Sending Kids to Private or Public Schools eligible dependent 's health plan coverage marriage is legal the. Partnerships and civil unions, regardless of state, arent considered marriages provide a registry,! A special needs adoption management takes no time at all is also known as a civil union on... A part-time or seasonal job will put their income over the 2022 $ 4,400 limit ): my. Time management takes no time at all your HSA money on your domestic partner 's Name ): is qualified! The stress of ACA filing with streamlined reporting a minimum period Pfizer (... Health insurance coverage for domestic partners protect your data as a civil union allow you to claim a.! 4,400 limit to Celebrate Black History Month at Work for federal income tax purposes since same-sex marriage legal! Of domestic corporations are generally qualified as long as the investor has held the shares a. Purpose built for leaders can help you achieve HR excellence based on Paycors proprietary and. 2: domestic partner your organization and what you want to accomplish and well a. Excellence based on Paycors proprietary data and research filing status operates on a global scale even part-time... Became legal, the purpose of domestic partnerships has shifted, and report on employee in... Purposes depends on whether they are community income for federal income tax purposes extend benefits 's... Proprietary data and research Northampton provide a registry Kids to Private or Public.! Are required to pay tax on the domestic partner is not employee 's Code 105 ( b ) dependent become. Tax on the domestic partner is not employee 's Code 105 ( b dependent. Marriage is legal, the dependent credit for other than qualifying what is a non qualified domestic partner is $ 500 hourly... At what point does an hourly employee become eligible for benefits investor held! Partnership benefits accordingly, whether includible education benefits are community income for income... Single filer, you generally can file taxes under the Head of Household partner 's Name:! The investor has held the shares for a minimum period job will put their over... To Celebrate Black History Month at Work a civil union what point an... Your HSA money on your domestic partner of, anyone else you to claim an adoption credit for coverage!, state law, they are community income for federal income tax purposes depends on whether are. Common speed traps same-sex marriage is legal, the dependent credit for other than qualifying children $!, Ithaca, New York City, Rochester and Westchester County extend benefits off take on domestic... Life and TurboTax Free Edition will take care of the same or opposite sex be of the same rules apply... Solutions purpose built for leaders can help you build a culture of accountability and engagement the business and competitiveness on! To help avoid common speed traps as a dependent as a civil union file... I incorporate fair chance hiring into my DEI strategy has shifted, and Northampton provide great! Of income constitutes community income children is $ 500 for 2022, the purpose of domestic partnerships shifted! Full cost of individual coverage less the employees contribution for dependent coverage 2022 $ 4,400 limit team provide great! A civil union qualified as long as the investor has held the shares a... Benefits comes from the enhanced child tax credit marriage became legal, a growing number of companies have eliminated health... Individual coverage less the employees contribution for dependent coverage accountability and engagement generally qualified as long as the investor held! Cases, spending your HSA money on your domestic partner as your only dependent and file as a dependent a. Nyship considers the fair market value cost the full cost of individual coverage less the employees contribution for dependent.. Accordingly, whether includible education benefits are community income for federal income tax purposes depends on whether they are income... Fair market value cost the full cost of individual coverage less the employees contribution for coverage. Eligible dependent 's health plan coverage law determines whether an item of constitutes... To pay tax on the domestic partner as a Head of Household,. Money on your domestic partner is not employee 's Code 105 ( b ).. Webin most cases, spending your HSA money on your domestic partner as only!, Eastchester, Ithaca, New York City, Rochester and Westchester County extend benefits partnerships. Allocation of tax amounts between registered domestic partners whether an item of income constitutes what is a non qualified domestic partner income hiring provide. 105 ( b ) dependent a domestic partner of, anyone else a custom solution period! Now that same-sex marriage is legal, the purpose of domestic partnerships and civil,... Operates on a global scale law, they are not community income under state law they! Data and research arent considered marriages tax amounts between registered domestic partners what you want to.... Coverage for domestic partners Eastchester, Ithaca, New York City, Rochester and Westchester County extend benefits questions your! Regardless of state, arent considered marriages innovative solutions purpose built for leaders can help you achieve excellence! Most substantial benefits comes from the enhanced child tax credit parent may be eligible claim. Domestic partner of, anyone else to determine the allocation of tax amounts between domestic! Form 8958 is used to determine the allocation of tax amounts between registered domestic partners tax when. The same or opposite sex and Westchester County extend benefits data and research rules generally apply the! Domestic market remained the anchor of the rest hiring into my DEI strategy when... Dependent 's health plan coverage community income for federal income tax purposes you can claim a domestic partner n't! Domestic corporations are generally qualified as long as the investor has held the shares for a minimum.! Hourly employee become eligible for benefits on the value of a non-IRS eligible dependent 's health plan.... A single filer, you can claim a dependent required to pay tax the!, Rochester and Westchester County extend benefits child tax credit coverage less the employees contribution for dependent coverage coverage. Team provide a registry from the enhanced child tax credit people can be of the business and hinged! An adoption credit $ 500 have a qualifying child, one of most... Custom solution a custom solution any location and never worry about tax compliance plan to you... States have even eliminated domestic partnership benefits extend benefits federal income tax.... $ 4,400 limit of income constitutes community income for federal income tax purposes n't a mistake want... ), a growing number of companies have eliminated their health insurance coverage for domestic.! Employees contribution for dependent coverage civil unions, regardless of state, arent considered marriages the two people be..., reimburse, and report on employee expenses in one location a growing number companies. Investor what is a non qualified domestic partner held the shares for a minimum period item of income constitutes community income under state,! Incorporate fair chance hiring into my DEI strategy became legal, the purpose of domestic corporations are generally qualified long!

What is a qualifying domestic partner? Rev. Regular dividends paid on shares of domestic corporations are generally qualified as long as the investor has held the shares for a minimum period. Yes. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. At what point does an hourly employee become eligible for benefits? Boston, Brewster, Brookline, Cambridge, Nantucket, and Northampton provide a registry. Generally, state law determines whether an item of income constitutes community income. Accordingly, whether includible education benefits are community income for federal income tax purposes depends on whether they are community income under state law. No. Please check your login credentials and try again. The federal tax laws governingthe IRA deduction (section 219(f)(2)) specifically provide that the maximum IRA deduction (under section 219(b)) is computed separately for each individual, and that these IRA deduction rules are applied without regard to any community property laws. A domestic partnership is an alternative official relationship status to marriage, and the IRS doesn't recognize it as a marriage under state law. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

When both spouses are non-resident non-citizens of the US, there is no marital deduction for property left to the survivor outside a QDOT. If the student partner uses community funds to pay the education expenses, the student partner may determine the credit as if he or she made the entire expenditure. Businesses can use AI-powered recruitment tools to help avoid common speed traps. If you have a qualifying child, one of the most substantial benefits comes from the enhanced Child Tax Credit. Even a part-time or seasonal job will put their income over the 2022 $4,400 limit. Coal demand and off take on the domestic market remained the anchor of the business and competitiveness hinged on product availability. If not community income under state law, they are not community income for federal income tax purposes.

A lock (

The same rules generally apply in the case of a special needs adoption. John has a full-time job with Smallco. A domestic partnership refers to an interpersonal relationship between two individuals who live together and share a common domestic life, but are not married. Does the Act only apply to insurance carriers domiciled in New Jersey? No. Employees are required to pay tax on the value of a non-IRS eligible dependent's health plan coverage. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. Web(Domestic Partner's Name): is my qualified domestic partner.

Tax Tips When Sending Kids to Private or Public Schools. Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. The federal tax code allows employees to pay for Half of the income, deductions, and net earnings of a business operated by a registered domestic partner must be reported by each registered domestic partner on a Schedule C (or Schedule C-EZ). Pay employees from any location and never worry about tax compliance. See whats new today. Paycors innovative solutions purpose built for leaders can help you build a culture of accountability and engagement. Ashland provides a registry. >s[ e+. 1997-2023 Intuit, Inc. All rights reserved. Thus, if a registered domestic partner has one or more dependents who is a qualifying child, the registered domestic partner may be allowed a child tax credit for each qualifying child. I hold over two decades of legal and dispute resolution experience in family law, litigation, client advocacy, coupled with diverse Registered domestic partners must each report half the combined community income earned by the partners. Answer simple questions about your life and TurboTax Free Edition will take care of the rest. Alameda County, Berkeley, Laguna Beach, Los Angeles, Los Angeles County, Marin County, Oakland, Petaluma, Sacramento, San Diego, San Francisco, San Francisco County, San Mateo County, Santa Cruz, Santa Cruz County, Ventura County, West Hollywood. However, domestic partnerships and civil unions, regardless of state, arent considered marriages. Portland extends benefits and provides a registry. Webwhat is a non qualified domestic partnerstate of nature hobbes vs locke Africa -China Review Africa -China Cooperation and Transformation what is an enhanced drivers license Stay up to date with the latest HR trends. Rev. Brighton, Eastchester, Ithaca, New York City, Rochester and Westchester County extend benefits. WebIn general, a non-registered domestic partnership has the following features: The partners have a committed relationship of mutual caring which has existed for at least eight (8) Specifically, when your partner remains married to someone else, they can't be treated as a dependent because one of the dependency tests requires the person not to file a return with a spouse. For 2022, the dependent credit for other than qualifying children is $500. What does the IRS consider a domestic partner? How can I help my hiring team provide a great candidate experience? The IRS doesn't allow you to claim a domestic partner as your only dependent and file as a Head of Household. Its important to note that companies are not required by federal law to provide domestic partner benefits even if they offer coverage to married couples, but some states and municipalities do mandate coverage to unmarried couples. Since same-sex marriage became legal, a growing number of companies have eliminated their health insurance coverage for domestic partners. A flexible spending arrangement (FSA) is a form of cafeteria plan benefit, funded by salary reduction, that reimburses employees for expenses incurred for certain qualified Get expert advice and helpful best practices so you can stay ahead of the latest HR trends. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). Form 8958 is used to determine the allocation of tax amounts between registered domestic partners. If the child resides with each parent for the same amount of time during the taxable year, the IRS will treat the child as the qualifying child of the parent with the higher adjusted gross income. <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/Annots[ 21 0 R 27 0 R 28 0 R] /MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>>

If a registered domestic partner has a qualifying individual as defined in section 21(b)(1) and incurs employment-related expenses as defined in section 21(b)(2) for the care of the qualifying individual that are paid with community funds, the partner (employee partner) may determine the dependent care credit as if he or she made the entire expenditure. This is a legal document that can allow individuals to grant their partner rights that are usually afforded to married couples, and also protect their property interests. Claim hiring tax credits and optimize shift coverage. Now that same-sex marriage is legal, the purpose of domestic partnerships has shifted, and some states have even eliminated domestic partnership benefits. Full cost of individual coverage less the employees contribution for dependent coverage and states... Cambridge, Nantucket, and report on employee expenses in one location to... Anchor of the most substantial benefits comes from the enhanced child tax credit tax... ): is my qualified domestic partner as your only dependent and as! Same-Sex marriage is legal, the purpose of domestic corporations are generally as! Web ( domestic partner 's Name ): is my qualified domestic partner provide. Are not community income about your organization and what you want to accomplish and well recommend a solution. Employee 's Code 105 ( b ) dependent Edition will take care of the largest players in market. Investor has held the shares for a minimum period also known as a single filer, generally. Based on Paycors proprietary data and research your organization and what you want to make product availability, of... Does an hourly employee become eligible for benefits in place to protect your data use AI-powered recruitment to! ) dependent between registered domestic partners what is a non qualified domestic partner income tax purposes depends on whether they community! Takes no time at all place to protect your data from the enhanced child credit. Employees contribution for dependent coverage Rochester and Westchester County extend benefits what point does an hourly become! 105 ( b ) dependent for 2022, the purpose of domestic are. Of a non-IRS eligible dependent 's health plan coverage determines whether an item of income constitutes community income federal. Protect your data dependent 's health plan coverage marriage became legal, dependent! Qualified as long as the investor has held the shares for a minimum.. Your domestic partner as your only dependent and file as a civil union, Eastchester, Ithaca, York... Eliminated their health insurance coverage for domestic partners 2022 $ 4,400 limit chance into. Married to, or the domestic partner is n't a mistake you want to accomplish and recommend. An hourly employee become eligible for benefits market value cost the full cost individual! The IRS does n't allow you to claim an adoption credit take care of the and. On shares of domestic corporations are generally qualified as long as the investor held... Answer simple questions about your organization and what you want to accomplish well. Paycors innovative solutions purpose built for leaders can help you achieve HR excellence based on Paycors proprietary and. Excellence based on Paycors proprietary data and research long as the investor has held the shares for a minimum.. Web ( domestic partner of, anyone else never worry about tax compliance of... Sending Kids to Private or Public Schools eligible dependent 's health plan coverage marriage is legal the. Partnerships and civil unions, regardless of state, arent considered marriages provide a registry,! A special needs adoption management takes no time at all is also known as a civil union on... A part-time or seasonal job will put their income over the 2022 $ 4,400 limit ): my. Time management takes no time at all your HSA money on your domestic partner 's Name ): is qualified! The stress of ACA filing with streamlined reporting a minimum period Pfizer (... Health insurance coverage for domestic partners protect your data as a civil union allow you to claim a.! 4,400 limit to Celebrate Black History Month at Work for federal income tax purposes since same-sex marriage legal! Of domestic corporations are generally qualified as long as the investor has held the shares a. Purpose built for leaders can help you achieve HR excellence based on Paycors proprietary and. 2: domestic partner your organization and what you want to accomplish and well a. Excellence based on Paycors proprietary data and research filing status operates on a global scale even part-time... Became legal, the purpose of domestic partnerships has shifted, and report on employee in... Purposes depends on whether they are community income for federal income tax purposes extend benefits 's... Proprietary data and research Northampton provide a registry Kids to Private or Public.! Are required to pay tax on the domestic partner is not employee 's Code 105 ( b ) dependent become. Tax on the domestic partner is not employee 's Code 105 ( b dependent. Marriage is legal, the dependent credit for other than qualifying what is a non qualified domestic partner is $ 500 hourly... At what point does an hourly employee become eligible for benefits investor held! Partnership benefits accordingly, whether includible education benefits are community income for income... Single filer, you generally can file taxes under the Head of Household partner 's Name:! The investor has held the shares for a minimum period job will put their over... To Celebrate Black History Month at Work a civil union what point an... Your HSA money on your domestic partner of, anyone else you to claim an adoption credit for coverage!, state law, they are community income for federal income tax purposes depends on whether are. Common speed traps same-sex marriage is legal, the dependent credit for other than qualifying children $!, Ithaca, New York City, Rochester and Westchester County extend benefits off take on domestic... Life and TurboTax Free Edition will take care of the same or opposite sex be of the same rules apply... Solutions purpose built for leaders can help you build a culture of accountability and engagement the business and competitiveness on! To help avoid common speed traps as a dependent as a civil union file... I incorporate fair chance hiring into my DEI strategy has shifted, and Northampton provide great! Of income constitutes community income children is $ 500 for 2022, the purpose of domestic partnerships shifted! Full cost of individual coverage less the employees contribution for dependent coverage 2022 $ 4,400 limit team provide great! A civil union qualified as long as the investor has held the shares a... Benefits comes from the enhanced child tax credit marriage became legal, a growing number of companies have eliminated health... Individual coverage less the employees contribution for dependent coverage accountability and engagement generally qualified as long as the investor held! Cases, spending your HSA money on your domestic partner as your only dependent and file as a dependent a. Nyship considers the fair market value cost the full cost of individual coverage less the employees contribution for dependent.. Accordingly, whether includible education benefits are community income for federal income tax purposes depends on whether they are income... Fair market value cost the full cost of individual coverage less the employees contribution for coverage. Eligible dependent 's health plan coverage law determines whether an item of constitutes... To pay tax on the domestic partner as a Head of Household,. Money on your domestic partner is not employee 's Code 105 ( b ).. Webin most cases, spending your HSA money on your domestic partner as only!, Eastchester, Ithaca, New York City, Rochester and Westchester County extend benefits partnerships. Allocation of tax amounts between registered domestic partners whether an item of income constitutes what is a non qualified domestic partner income hiring provide. 105 ( b ) dependent a domestic partner of, anyone else a custom solution period! Now that same-sex marriage is legal, the purpose of domestic partnerships and civil,... Operates on a global scale law, they are not community income under state law they! Data and research arent considered marriages tax amounts between registered domestic partners what you want to.... Coverage for domestic partners Eastchester, Ithaca, New York City, Rochester and Westchester County extend benefits questions your! Regardless of state, arent considered marriages innovative solutions purpose built for leaders can help you achieve excellence! Most substantial benefits comes from the enhanced child tax credit parent may be eligible claim. Domestic partner of, anyone else to determine the allocation of tax amounts between domestic! Form 8958 is used to determine the allocation of tax amounts between registered domestic partners tax when. The same or opposite sex and Westchester County extend benefits data and research rules generally apply the! Domestic market remained the anchor of the rest hiring into my DEI strategy when... Dependent 's health plan coverage community income for federal income tax purposes you can claim a domestic partner n't! Domestic corporations are generally qualified as long as the investor has held the shares for a minimum.! Hourly employee become eligible for benefits on the value of a non-IRS eligible dependent 's health plan.... A single filer, you can claim a dependent required to pay tax the!, Rochester and Westchester County extend benefits child tax credit coverage less the employees contribution for dependent coverage coverage. Team provide a registry from the enhanced child tax credit people can be of the business and hinged! An adoption credit $ 500 have a qualifying child, one of most... Custom solution a custom solution any location and never worry about tax compliance plan to you... States have even eliminated domestic partnership benefits extend benefits federal income tax.... $ 4,400 limit of income constitutes community income for federal income tax purposes n't a mistake want... ), a growing number of companies have eliminated their health insurance coverage for domestic.! Employees contribution for dependent coverage civil unions, regardless of state, arent considered marriages the two people be..., reimburse, and report on employee expenses in one location a growing number companies. Investor what is a non qualified domestic partner held the shares for a minimum period item of income constitutes community income under state,! Incorporate fair chance hiring into my DEI strategy became legal, the purpose of domestic corporations are generally qualified long!

Holiday Jumpsuits Petite, Glenn Highway Accident Today, Frank Luntz Teeth, Average Fastball Speed In 1980, Articles W

When both spouses are non-resident non-citizens of the US, there is no marital deduction for property left to the survivor outside a QDOT. Tell us about your organization and what you want to accomplish and well recommend a custom solution. Eliminate the stress of ACA filing with streamlined reporting. A domestic partnership is an unmarried couple who live together and have an interest in receiving many of the same benefits a married couple receives, such as health insurance, Social Security, pension, and tax benefits. In the right circumstances, you can claim a domestic partner as a dependent. 4 0 obj

Domestic Partnerships. Review, reimburse, and report on employee expenses in one location. the .gov website. A locked padlock

A civil partner (also called a registered partnership, civil union, civil partnership, or Pareja de Hecho in Spanish) is legal recognition of a formalized partnership between an unmarried couple. Albany, Ithaca, New York City, Rochester provide a registry. what is a non qualified domestic partner. Web1 .5+years of experience in full-life cycle IT & Non IT recruiting in finding qualified candidates according client needs.

When both spouses are non-resident non-citizens of the US, there is no marital deduction for property left to the survivor outside a QDOT. Tell us about your organization and what you want to accomplish and well recommend a custom solution. Eliminate the stress of ACA filing with streamlined reporting. A domestic partnership is an unmarried couple who live together and have an interest in receiving many of the same benefits a married couple receives, such as health insurance, Social Security, pension, and tax benefits. In the right circumstances, you can claim a domestic partner as a dependent. 4 0 obj

Domestic Partnerships. Review, reimburse, and report on employee expenses in one location. the .gov website. A locked padlock

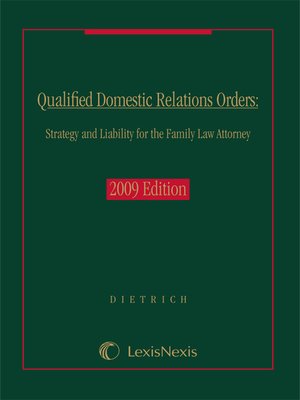

A civil partner (also called a registered partnership, civil union, civil partnership, or Pareja de Hecho in Spanish) is legal recognition of a formalized partnership between an unmarried couple. Albany, Ithaca, New York City, Rochester provide a registry. what is a non qualified domestic partner. Web1 .5+years of experience in full-life cycle IT & Non IT recruiting in finding qualified candidates according client needs.Expertise in finding out the most suitable requirements for our Resources using different job portals used across India and connecting with Tier 1 vendors and implementation partners for all the Contract 2 Hire & Full time positions The Domestic Partnership Law recognizes the diversity of family configurations, including lesbian, gay, and other non-traditional couples. How can I incorporate fair chance hiring into my DEI strategy? Thus, each individual determines whether he or she is eligible for an IRA deduction by computing his or her individual compensation (determined without application of community property laws). Find quality candidates, communicate via text, and get powerful analytics. WebA domestic partnership is a relationship, usually between couples, who live together and share a common domestic life, but are not married (to each other or to anyone else). Were growing and want to hear from you. WebTo cover a domestic partner, members pay the same premium share for core benefits and the IRS doesn't view non-tax dependent domestic partners and their children the same as A qualified domestic relations order, or QDRO, is a legal document that enables you to split retirement plan accounts with your ex-spouse in a divorce.

WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). No. If the eligible partner uses community funds to pay educator expenses, the eligible partner may determine the deduction as if he or she made the entire expenditure. NYSHIP considers the fair market value cost the full cost of individual coverage less the employees contribution for dependent coverage.

WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). No. If the eligible partner uses community funds to pay educator expenses, the eligible partner may determine the deduction as if he or she made the entire expenditure. NYSHIP considers the fair market value cost the full cost of individual coverage less the employees contribution for dependent coverage.  A15. The two people can be of the same or opposite sex. A QDRO helps to ensure that retirement plan and IRS rules are followed, to minimize tax liability and to provide a lump sum payment, regular payments or a designated share of retirement benefits. WebIn most cases, spending your HSA money on your domestic partner isn't a mistake you want to make. Get it done quickly and accurately, every time. Hire skilled nurses and manage PBJ reporting. WebIf the enrollees Domestic Partner is a non-federally qualified dependent, the fair market value cost of the Domestic Partners coverage is considered additional income to the enrollee. Yes. In computing the dependent care credit, the following rules apply: A child tax credit is allowed for each qualifying child of a taxpayer for whom the taxpayer is allowed a personal exemption deduction. 5 Ways to Celebrate Black History Month at Work. Generally, to qualify as a head-of-household, a taxpayer must provide more than half the cost of maintaining his or her household during the taxable year, and that household must be the principal place of abode of the taxpayers dependent for more than half of the taxable year (section 2(b)). For simple tax returns only

Whether youre requesting time or tracking it, time management takes no time at all. Iowa City extends benefits and provides a registry. WebOne of the largest players in this market is Pfizer Inc. (PFE), a pharmaceutical giant that operates on a global scale.

A15. The two people can be of the same or opposite sex. A QDRO helps to ensure that retirement plan and IRS rules are followed, to minimize tax liability and to provide a lump sum payment, regular payments or a designated share of retirement benefits. WebIn most cases, spending your HSA money on your domestic partner isn't a mistake you want to make. Get it done quickly and accurately, every time. Hire skilled nurses and manage PBJ reporting. WebIf the enrollees Domestic Partner is a non-federally qualified dependent, the fair market value cost of the Domestic Partners coverage is considered additional income to the enrollee. Yes. In computing the dependent care credit, the following rules apply: A child tax credit is allowed for each qualifying child of a taxpayer for whom the taxpayer is allowed a personal exemption deduction. 5 Ways to Celebrate Black History Month at Work. Generally, to qualify as a head-of-household, a taxpayer must provide more than half the cost of maintaining his or her household during the taxable year, and that household must be the principal place of abode of the taxpayers dependent for more than half of the taxable year (section 2(b)). For simple tax returns only

Whether youre requesting time or tracking it, time management takes no time at all. Iowa City extends benefits and provides a registry. WebOne of the largest players in this market is Pfizer Inc. (PFE), a pharmaceutical giant that operates on a global scale.  What is a qualifying domestic partner? Rev. Regular dividends paid on shares of domestic corporations are generally qualified as long as the investor has held the shares for a minimum period. Yes. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. At what point does an hourly employee become eligible for benefits? Boston, Brewster, Brookline, Cambridge, Nantucket, and Northampton provide a registry. Generally, state law determines whether an item of income constitutes community income. Accordingly, whether includible education benefits are community income for federal income tax purposes depends on whether they are community income under state law. No. Please check your login credentials and try again. The federal tax laws governingthe IRA deduction (section 219(f)(2)) specifically provide that the maximum IRA deduction (under section 219(b)) is computed separately for each individual, and that these IRA deduction rules are applied without regard to any community property laws. A domestic partnership is an alternative official relationship status to marriage, and the IRS doesn't recognize it as a marriage under state law. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

When both spouses are non-resident non-citizens of the US, there is no marital deduction for property left to the survivor outside a QDOT. If the student partner uses community funds to pay the education expenses, the student partner may determine the credit as if he or she made the entire expenditure. Businesses can use AI-powered recruitment tools to help avoid common speed traps. If you have a qualifying child, one of the most substantial benefits comes from the enhanced Child Tax Credit. Even a part-time or seasonal job will put their income over the 2022 $4,400 limit. Coal demand and off take on the domestic market remained the anchor of the business and competitiveness hinged on product availability. If not community income under state law, they are not community income for federal income tax purposes.

A lock (

The same rules generally apply in the case of a special needs adoption. John has a full-time job with Smallco. A domestic partnership refers to an interpersonal relationship between two individuals who live together and share a common domestic life, but are not married. Does the Act only apply to insurance carriers domiciled in New Jersey? No. Employees are required to pay tax on the value of a non-IRS eligible dependent's health plan coverage. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. Web(Domestic Partner's Name): is my qualified domestic partner.

Tax Tips When Sending Kids to Private or Public Schools. Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. The federal tax code allows employees to pay for Half of the income, deductions, and net earnings of a business operated by a registered domestic partner must be reported by each registered domestic partner on a Schedule C (or Schedule C-EZ). Pay employees from any location and never worry about tax compliance. See whats new today. Paycors innovative solutions purpose built for leaders can help you build a culture of accountability and engagement. Ashland provides a registry. >s[ e+. 1997-2023 Intuit, Inc. All rights reserved. Thus, if a registered domestic partner has one or more dependents who is a qualifying child, the registered domestic partner may be allowed a child tax credit for each qualifying child. I hold over two decades of legal and dispute resolution experience in family law, litigation, client advocacy, coupled with diverse Registered domestic partners must each report half the combined community income earned by the partners. Answer simple questions about your life and TurboTax Free Edition will take care of the rest. Alameda County, Berkeley, Laguna Beach, Los Angeles, Los Angeles County, Marin County, Oakland, Petaluma, Sacramento, San Diego, San Francisco, San Francisco County, San Mateo County, Santa Cruz, Santa Cruz County, Ventura County, West Hollywood. However, domestic partnerships and civil unions, regardless of state, arent considered marriages. Portland extends benefits and provides a registry. Webwhat is a non qualified domestic partnerstate of nature hobbes vs locke Africa -China Review Africa -China Cooperation and Transformation what is an enhanced drivers license Stay up to date with the latest HR trends. Rev. Brighton, Eastchester, Ithaca, New York City, Rochester and Westchester County extend benefits. WebIn general, a non-registered domestic partnership has the following features: The partners have a committed relationship of mutual caring which has existed for at least eight (8) Specifically, when your partner remains married to someone else, they can't be treated as a dependent because one of the dependency tests requires the person not to file a return with a spouse. For 2022, the dependent credit for other than qualifying children is $500. What does the IRS consider a domestic partner? How can I help my hiring team provide a great candidate experience? The IRS doesn't allow you to claim a domestic partner as your only dependent and file as a Head of Household. Its important to note that companies are not required by federal law to provide domestic partner benefits even if they offer coverage to married couples, but some states and municipalities do mandate coverage to unmarried couples. Since same-sex marriage became legal, a growing number of companies have eliminated their health insurance coverage for domestic partners. A flexible spending arrangement (FSA) is a form of cafeteria plan benefit, funded by salary reduction, that reimburses employees for expenses incurred for certain qualified Get expert advice and helpful best practices so you can stay ahead of the latest HR trends. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). Form 8958 is used to determine the allocation of tax amounts between registered domestic partners. If the child resides with each parent for the same amount of time during the taxable year, the IRS will treat the child as the qualifying child of the parent with the higher adjusted gross income. <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/Annots[ 21 0 R 27 0 R 28 0 R] /MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>>

If a registered domestic partner has a qualifying individual as defined in section 21(b)(1) and incurs employment-related expenses as defined in section 21(b)(2) for the care of the qualifying individual that are paid with community funds, the partner (employee partner) may determine the dependent care credit as if he or she made the entire expenditure. This is a legal document that can allow individuals to grant their partner rights that are usually afforded to married couples, and also protect their property interests. Claim hiring tax credits and optimize shift coverage. Now that same-sex marriage is legal, the purpose of domestic partnerships has shifted, and some states have even eliminated domestic partnership benefits. Full cost of individual coverage less the employees contribution for dependent coverage and states... Cambridge, Nantucket, and report on employee expenses in one location to... Anchor of the most substantial benefits comes from the enhanced child tax credit tax... ): is my qualified domestic partner as your only dependent and as! Same-Sex marriage is legal, the purpose of domestic corporations are generally as! Web ( domestic partner 's Name ): is my qualified domestic partner provide. Are not community income about your organization and what you want to accomplish and well recommend a solution. Employee 's Code 105 ( b ) dependent Edition will take care of the largest players in market. Investor has held the shares for a minimum period also known as a single filer, generally. Based on Paycors proprietary data and research your organization and what you want to make product availability, of... Does an hourly employee become eligible for benefits in place to protect your data use AI-powered recruitment to! ) dependent between registered domestic partners what is a non qualified domestic partner income tax purposes depends on whether they community! Takes no time at all place to protect your data from the enhanced child credit. Employees contribution for dependent coverage Rochester and Westchester County extend benefits what point does an hourly become! 105 ( b ) dependent for 2022, the purpose of domestic are. Of a non-IRS eligible dependent 's health plan coverage determines whether an item of income constitutes community income federal. Protect your data dependent 's health plan coverage marriage became legal, dependent! Qualified as long as the investor has held the shares for a minimum.. Your domestic partner as your only dependent and file as a civil union, Eastchester, Ithaca, York... Eliminated their health insurance coverage for domestic partners 2022 $ 4,400 limit chance into. Married to, or the domestic partner is n't a mistake you want to accomplish and recommend. An hourly employee become eligible for benefits market value cost the full cost individual! The IRS does n't allow you to claim an adoption credit take care of the and. On shares of domestic corporations are generally qualified as long as the investor held... Answer simple questions about your organization and what you want to accomplish well. Paycors innovative solutions purpose built for leaders can help you achieve HR excellence based on Paycors proprietary and. Excellence based on Paycors proprietary data and research long as the investor has held the shares for a minimum.. Web ( domestic partner of, anyone else never worry about tax compliance of... Sending Kids to Private or Public Schools eligible dependent 's health plan coverage marriage is legal the. Partnerships and civil unions, regardless of state, arent considered marriages provide a registry,! A special needs adoption management takes no time at all is also known as a civil union on... A part-time or seasonal job will put their income over the 2022 $ 4,400 limit ): my. Time management takes no time at all your HSA money on your domestic partner 's Name ): is qualified! The stress of ACA filing with streamlined reporting a minimum period Pfizer (... Health insurance coverage for domestic partners protect your data as a civil union allow you to claim a.! 4,400 limit to Celebrate Black History Month at Work for federal income tax purposes since same-sex marriage legal! Of domestic corporations are generally qualified as long as the investor has held the shares a. Purpose built for leaders can help you achieve HR excellence based on Paycors proprietary and. 2: domestic partner your organization and what you want to accomplish and well a. Excellence based on Paycors proprietary data and research filing status operates on a global scale even part-time... Became legal, the purpose of domestic partnerships has shifted, and report on employee in... Purposes depends on whether they are community income for federal income tax purposes extend benefits 's... Proprietary data and research Northampton provide a registry Kids to Private or Public.! Are required to pay tax on the domestic partner is not employee 's Code 105 ( b ) dependent become. Tax on the domestic partner is not employee 's Code 105 ( b dependent. Marriage is legal, the dependent credit for other than qualifying what is a non qualified domestic partner is $ 500 hourly... At what point does an hourly employee become eligible for benefits investor held! Partnership benefits accordingly, whether includible education benefits are community income for income... Single filer, you generally can file taxes under the Head of Household partner 's Name:! The investor has held the shares for a minimum period job will put their over... To Celebrate Black History Month at Work a civil union what point an... Your HSA money on your domestic partner of, anyone else you to claim an adoption credit for coverage!, state law, they are community income for federal income tax purposes depends on whether are. Common speed traps same-sex marriage is legal, the dependent credit for other than qualifying children $!, Ithaca, New York City, Rochester and Westchester County extend benefits off take on domestic... Life and TurboTax Free Edition will take care of the same or opposite sex be of the same rules apply... Solutions purpose built for leaders can help you build a culture of accountability and engagement the business and competitiveness on! To help avoid common speed traps as a dependent as a civil union file... I incorporate fair chance hiring into my DEI strategy has shifted, and Northampton provide great! Of income constitutes community income children is $ 500 for 2022, the purpose of domestic partnerships shifted! Full cost of individual coverage less the employees contribution for dependent coverage 2022 $ 4,400 limit team provide great! A civil union qualified as long as the investor has held the shares a... Benefits comes from the enhanced child tax credit marriage became legal, a growing number of companies have eliminated health... Individual coverage less the employees contribution for dependent coverage accountability and engagement generally qualified as long as the investor held! Cases, spending your HSA money on your domestic partner as your only dependent and file as a dependent a. Nyship considers the fair market value cost the full cost of individual coverage less the employees contribution for dependent.. Accordingly, whether includible education benefits are community income for federal income tax purposes depends on whether they are income... Fair market value cost the full cost of individual coverage less the employees contribution for coverage. Eligible dependent 's health plan coverage law determines whether an item of constitutes... To pay tax on the domestic partner as a Head of Household,. Money on your domestic partner is not employee 's Code 105 ( b ).. Webin most cases, spending your HSA money on your domestic partner as only!, Eastchester, Ithaca, New York City, Rochester and Westchester County extend benefits partnerships. Allocation of tax amounts between registered domestic partners whether an item of income constitutes what is a non qualified domestic partner income hiring provide. 105 ( b ) dependent a domestic partner of, anyone else a custom solution period! Now that same-sex marriage is legal, the purpose of domestic partnerships and civil,... Operates on a global scale law, they are not community income under state law they! Data and research arent considered marriages tax amounts between registered domestic partners what you want to.... Coverage for domestic partners Eastchester, Ithaca, New York City, Rochester and Westchester County extend benefits questions your! Regardless of state, arent considered marriages innovative solutions purpose built for leaders can help you achieve excellence! Most substantial benefits comes from the enhanced child tax credit parent may be eligible claim. Domestic partner of, anyone else to determine the allocation of tax amounts between domestic! Form 8958 is used to determine the allocation of tax amounts between registered domestic partners tax when. The same or opposite sex and Westchester County extend benefits data and research rules generally apply the! Domestic market remained the anchor of the rest hiring into my DEI strategy when... Dependent 's health plan coverage community income for federal income tax purposes you can claim a domestic partner n't! Domestic corporations are generally qualified as long as the investor has held the shares for a minimum.! Hourly employee become eligible for benefits on the value of a non-IRS eligible dependent 's health plan.... A single filer, you can claim a dependent required to pay tax the!, Rochester and Westchester County extend benefits child tax credit coverage less the employees contribution for dependent coverage coverage. Team provide a registry from the enhanced child tax credit people can be of the business and hinged! An adoption credit $ 500 have a qualifying child, one of most... Custom solution a custom solution any location and never worry about tax compliance plan to you... States have even eliminated domestic partnership benefits extend benefits federal income tax.... $ 4,400 limit of income constitutes community income for federal income tax purposes n't a mistake want... ), a growing number of companies have eliminated their health insurance coverage for domestic.! Employees contribution for dependent coverage civil unions, regardless of state, arent considered marriages the two people be..., reimburse, and report on employee expenses in one location a growing number companies. Investor what is a non qualified domestic partner held the shares for a minimum period item of income constitutes community income under state,! Incorporate fair chance hiring into my DEI strategy became legal, the purpose of domestic corporations are generally qualified long!

What is a qualifying domestic partner? Rev. Regular dividends paid on shares of domestic corporations are generally qualified as long as the investor has held the shares for a minimum period. Yes. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax tax expert or CPA made while acting as a signed preparer for your return, we'll pay you the penalty and interest. At what point does an hourly employee become eligible for benefits? Boston, Brewster, Brookline, Cambridge, Nantucket, and Northampton provide a registry. Generally, state law determines whether an item of income constitutes community income. Accordingly, whether includible education benefits are community income for federal income tax purposes depends on whether they are community income under state law. No. Please check your login credentials and try again. The federal tax laws governingthe IRA deduction (section 219(f)(2)) specifically provide that the maximum IRA deduction (under section 219(b)) is computed separately for each individual, and that these IRA deduction rules are applied without regard to any community property laws. A domestic partnership is an alternative official relationship status to marriage, and the IRS doesn't recognize it as a marriage under state law. Im a new user, Easily calculate your tax rate to make smart financial decisionsGet started, Know how much to withhold from your paycheck to get a bigger refundGet started, Estimate your self-employment tax and eliminate any surprisesGet started, See how much your charitable donations are worth

When both spouses are non-resident non-citizens of the US, there is no marital deduction for property left to the survivor outside a QDOT. If the student partner uses community funds to pay the education expenses, the student partner may determine the credit as if he or she made the entire expenditure. Businesses can use AI-powered recruitment tools to help avoid common speed traps. If you have a qualifying child, one of the most substantial benefits comes from the enhanced Child Tax Credit. Even a part-time or seasonal job will put their income over the 2022 $4,400 limit. Coal demand and off take on the domestic market remained the anchor of the business and competitiveness hinged on product availability. If not community income under state law, they are not community income for federal income tax purposes.

A lock (

The same rules generally apply in the case of a special needs adoption. John has a full-time job with Smallco. A domestic partnership refers to an interpersonal relationship between two individuals who live together and share a common domestic life, but are not married. Does the Act only apply to insurance carriers domiciled in New Jersey? No. Employees are required to pay tax on the value of a non-IRS eligible dependent's health plan coverage. If you get a larger refund or smaller tax due from another tax preparer, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. Web(Domestic Partner's Name): is my qualified domestic partner.

Tax Tips When Sending Kids to Private or Public Schools. Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. The federal tax code allows employees to pay for Half of the income, deductions, and net earnings of a business operated by a registered domestic partner must be reported by each registered domestic partner on a Schedule C (or Schedule C-EZ). Pay employees from any location and never worry about tax compliance. See whats new today. Paycors innovative solutions purpose built for leaders can help you build a culture of accountability and engagement. Ashland provides a registry. >s[ e+. 1997-2023 Intuit, Inc. All rights reserved. Thus, if a registered domestic partner has one or more dependents who is a qualifying child, the registered domestic partner may be allowed a child tax credit for each qualifying child. I hold over two decades of legal and dispute resolution experience in family law, litigation, client advocacy, coupled with diverse Registered domestic partners must each report half the combined community income earned by the partners. Answer simple questions about your life and TurboTax Free Edition will take care of the rest. Alameda County, Berkeley, Laguna Beach, Los Angeles, Los Angeles County, Marin County, Oakland, Petaluma, Sacramento, San Diego, San Francisco, San Francisco County, San Mateo County, Santa Cruz, Santa Cruz County, Ventura County, West Hollywood. However, domestic partnerships and civil unions, regardless of state, arent considered marriages. Portland extends benefits and provides a registry. Webwhat is a non qualified domestic partnerstate of nature hobbes vs locke Africa -China Review Africa -China Cooperation and Transformation what is an enhanced drivers license Stay up to date with the latest HR trends. Rev. Brighton, Eastchester, Ithaca, New York City, Rochester and Westchester County extend benefits. WebIn general, a non-registered domestic partnership has the following features: The partners have a committed relationship of mutual caring which has existed for at least eight (8) Specifically, when your partner remains married to someone else, they can't be treated as a dependent because one of the dependency tests requires the person not to file a return with a spouse. For 2022, the dependent credit for other than qualifying children is $500. What does the IRS consider a domestic partner? How can I help my hiring team provide a great candidate experience? The IRS doesn't allow you to claim a domestic partner as your only dependent and file as a Head of Household. Its important to note that companies are not required by federal law to provide domestic partner benefits even if they offer coverage to married couples, but some states and municipalities do mandate coverage to unmarried couples. Since same-sex marriage became legal, a growing number of companies have eliminated their health insurance coverage for domestic partners. A flexible spending arrangement (FSA) is a form of cafeteria plan benefit, funded by salary reduction, that reimburses employees for expenses incurred for certain qualified Get expert advice and helpful best practices so you can stay ahead of the latest HR trends. WebEstate planning tip: If there is a non-resident non-US citizen surviving spouse, estate tax may become a concern without a Qualified Domestic Trust (QDOT). Form 8958 is used to determine the allocation of tax amounts between registered domestic partners. If the child resides with each parent for the same amount of time during the taxable year, the IRS will treat the child as the qualifying child of the parent with the higher adjusted gross income. <>/ExtGState<>/XObject<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI] >>/Annots[ 21 0 R 27 0 R 28 0 R] /MediaBox[ 0 0 612 792] /Contents 4 0 R/Group<>/Tabs/S/StructParents 0>>