Typically, the risk component of a liability will be calculated separate from the discount rate, whereas for assets, the uncertainty may be considered in the selection of the discount rate or separately. As such, it follows that the hypothetical transaction used for valuation is based on a transfer to a credit equivalent entity that is in need of funding and willing to take on the terms of the obligation. The cost savings and premium profit methods are other ways to value intangible assets but are used less frequently. Web Inclusion/exclusion of any overhead costs and the allocation rate used;the asset including materials and labour Inclusion of opportunity costs; Functional, economic, and The first method, commonly referred to as a bottom-up approach, measures the liability as the direct, incremental costs to fulfill the legal performance obligation, plus a reasonable profit margin if associated with goods or services being provided, and a premium for risks associated with price variability. The most commonly used terminal value technique is the constant growth method (CGM). That technique would consider the acquirees cash flows after payment of the royalty rate to the acquirer for the right that is being reacquired. Goodwill is excluded as it is generally not viewed as an asset that can be reliably measured. If the PFI is not adjusted, it may be necessary to only consider the IRR as a starting point for determining the discount rates for intangible assets. Intangible assets are the second-largest The income approach is typically used to value assets that generate a discrete income stream (e.g., a power plant), or that act in concert with other tangible assets (e.g., a network of wireless towers). For further discussion of IPR&D not intended to be used by the acquirer refer to.  Consideration of a noncontrolling (minority interest) discount may be necessary to account for synergies that would not transfer to the NCI. The concern with reliance on the value from the perspective of the asset holder is that assets and liabilities typically transact in different markets and therefore may have different values. How could the fair value of the contingent consideration arrangement be calculated based on the arrangement between Company A and Company B? Because the expected claim amounts reflect the probability weighted average of the possible outcomes identified, the expected cash flows do not depend on the occurrence of a specific event. For example, the cash flows may reflect a most likely or promised cash flow scenario, such as a zero coupon bond that promises to repay a principal amount at the end of a fixed time period. WebA backlog is a list of tasks required to support a larger strategic plan. This results in the going concern value being deducted from the overall business value. Follow along as we demonstrate how to use the site, Understanding the interaction between corporate finance, valuation, and accounting concepts is important when estimating fair value measurements for business combinations. Similarly, the value of the excess returns driven by intangible assets other than the subject intangible asset is also excluded from the overall business cash flows by using cash flows providing only market participant or normalized levels of returns. An entitys financial liabilities often are referred to as debt and its nonfinancial liabilities are referred to as operating or performance obligations. Significant professional judgment is required to determine the stratified discount rates that should be applied in performing a WARA reconciliation. Cash flow models will use either conditional or expected cash flows; and other valuation inputs need to be consistent with the approach chosen. used in measuring the fair value of the identified assets and liabilities of the entity. It is discussed in. It is unlikely that cash flows of a proxy would be a better indication of the value of a primary asset. On the acquisition date, Company B has lumber raw materials (that are used in the production process) that were initially purchased (historical cost) at $390 per 1,000 board feet. Key inputs of this method are the assumptions of how much time and additional expense are required to recreate the intangible asset and the amount of lost cash flows that should be assumed during this period. The business combination guidance clarifies that assets that an acquirer does not intend to use or intends to use in a way other than their highest and best use must still be recorded at fair value based on market participant assumptions. There may be several acceptable methods for determining the fair value of the forward contract. We use cookies to personalize content and to provide you with an improved user experience. PFI that incorrectly uses book amortization and depreciation will result in a mismatch between the post-tax amortization and depreciation expense and the pre-tax amount added back to determine free cash flow. However, this method must be used cautiously to avoid significant misstatement of the fair value resulting from growth rate differences. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. The level of investment must be consistent with the growth during the projection period and the terminal year investment must provide a normalized level of growth. WebHistory of Intangible Assets Changes in technology impact mankinds development 15th century printing press 19th century telegraph 20th century telephone, television and Internet Global economies have experienced a tremendous shift from bricks and mortar business to information based businesses Increased recognition that intangibles add value Therefore, this valuation technique should consider the synergies in the transaction and whether they may be appropriate to the company being valued. The enhancement in value is measured as a separate unit of account rather than as additional value to the acquirers pre-existing trade name, even if assumptions about the enhanced value of the existing asset are the basis for valuation of the defensive asset. This method assumes that the NCI shareholder will participate equally with the controlling shareholder in the economic benefits of the post-combination entity which may not always be appropriate. For example, a contingent payment that is triggered by a drug achieving an R&D milestone is often valued using a scenario-based method. The fair value calculation using both conditional and expected cash flow approaches should give a similar result. WebDepreciation. Since the starting point in most valuations is cash flows, the PFI needs to be on a cash basis. This is because the royalty is the cost for licensing completed technology (whether current or future) from a third party. If the PFI was developed on the assumption that future technology will be developed in-house, it would reflect cash expenditures for research and development. It provides examples of intangible assets commonly found in business combinations and explains how they might be valued. Additionally, understanding the significant issues that were subject to the negotiations and how they were eventually resolved may provide valuable insight into determining the existence of a control premium. Additional considerations would include the following: Regardless of the methodology used in valuing the defensive asset, it is important not to include value in a defensive asset that is already included in the value of another asset.

Consideration of a noncontrolling (minority interest) discount may be necessary to account for synergies that would not transfer to the NCI. The concern with reliance on the value from the perspective of the asset holder is that assets and liabilities typically transact in different markets and therefore may have different values. How could the fair value of the contingent consideration arrangement be calculated based on the arrangement between Company A and Company B? Because the expected claim amounts reflect the probability weighted average of the possible outcomes identified, the expected cash flows do not depend on the occurrence of a specific event. For example, the cash flows may reflect a most likely or promised cash flow scenario, such as a zero coupon bond that promises to repay a principal amount at the end of a fixed time period. WebA backlog is a list of tasks required to support a larger strategic plan. This results in the going concern value being deducted from the overall business value. Follow along as we demonstrate how to use the site, Understanding the interaction between corporate finance, valuation, and accounting concepts is important when estimating fair value measurements for business combinations. Similarly, the value of the excess returns driven by intangible assets other than the subject intangible asset is also excluded from the overall business cash flows by using cash flows providing only market participant or normalized levels of returns. An entitys financial liabilities often are referred to as debt and its nonfinancial liabilities are referred to as operating or performance obligations. Significant professional judgment is required to determine the stratified discount rates that should be applied in performing a WARA reconciliation. Cash flow models will use either conditional or expected cash flows; and other valuation inputs need to be consistent with the approach chosen. used in measuring the fair value of the identified assets and liabilities of the entity. It is discussed in. It is unlikely that cash flows of a proxy would be a better indication of the value of a primary asset. On the acquisition date, Company B has lumber raw materials (that are used in the production process) that were initially purchased (historical cost) at $390 per 1,000 board feet. Key inputs of this method are the assumptions of how much time and additional expense are required to recreate the intangible asset and the amount of lost cash flows that should be assumed during this period. The business combination guidance clarifies that assets that an acquirer does not intend to use or intends to use in a way other than their highest and best use must still be recorded at fair value based on market participant assumptions. There may be several acceptable methods for determining the fair value of the forward contract. We use cookies to personalize content and to provide you with an improved user experience. PFI that incorrectly uses book amortization and depreciation will result in a mismatch between the post-tax amortization and depreciation expense and the pre-tax amount added back to determine free cash flow. However, this method must be used cautiously to avoid significant misstatement of the fair value resulting from growth rate differences. PwC refers to the US member firm or one of its subsidiaries or affiliates, and may sometimes refer to the PwC network. The level of investment must be consistent with the growth during the projection period and the terminal year investment must provide a normalized level of growth. WebHistory of Intangible Assets Changes in technology impact mankinds development 15th century printing press 19th century telegraph 20th century telephone, television and Internet Global economies have experienced a tremendous shift from bricks and mortar business to information based businesses Increased recognition that intangibles add value Therefore, this valuation technique should consider the synergies in the transaction and whether they may be appropriate to the company being valued. The enhancement in value is measured as a separate unit of account rather than as additional value to the acquirers pre-existing trade name, even if assumptions about the enhanced value of the existing asset are the basis for valuation of the defensive asset. This method assumes that the NCI shareholder will participate equally with the controlling shareholder in the economic benefits of the post-combination entity which may not always be appropriate. For example, a contingent payment that is triggered by a drug achieving an R&D milestone is often valued using a scenario-based method. The fair value calculation using both conditional and expected cash flow approaches should give a similar result. WebDepreciation. Since the starting point in most valuations is cash flows, the PFI needs to be on a cash basis. This is because the royalty is the cost for licensing completed technology (whether current or future) from a third party. If the PFI was developed on the assumption that future technology will be developed in-house, it would reflect cash expenditures for research and development. It provides examples of intangible assets commonly found in business combinations and explains how they might be valued. Additionally, understanding the significant issues that were subject to the negotiations and how they were eventually resolved may provide valuable insight into determining the existence of a control premium. Additional considerations would include the following: Regardless of the methodology used in valuing the defensive asset, it is important not to include value in a defensive asset that is already included in the value of another asset.  Although Company A has determined that it will not use Company Bs trademark, other market participants would use Company Bs trademark. Should Company XYZ ascribe the value contributed by the intangible assets (brand name) to shirts in finished goods inventory as part of its acquisition accounting? While an income approach is most frequently used, a market approach using appropriate guideline companies or transactions helps to check the reasonableness of the income approach. If a difference exists between the IRR and the WACC and it is driven by the PFI (i.e., optimistic or conservative bias rather than expected cash flows, while the consideration transferred is the fair value of the acquiree), leading practice would be to revise the PFI to better represent expected cash flows and recalculate the IRR. These include the profit split method (in which the profits of the business are allocated to the various business functions), the return on assets method (in which returns on other assets are subtracted from the profits of the business), and the comparable profits method (in which the profitability measures of entities or business units that carry out activities similar to that provided by the intangible asset are considered). That is, the discount rate selected should adjust for only those risks not already incorporated into the cash flows. For all other entities, the new guidance iseffective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years. In accordance with, The fair value of the controlling ownership interest acquired may generally be valued based on the consideration transferred. In pull marketing, the premise is to pull customers to the products (e.g., a customer goes to a department store to buy luxury brand purses). Company A acquires technology from Company B in a business combination. Conditional cash flows are based on a single outcome that is dependent upon the occurrence of specific events. The scenario-based technique involves developing discrete scenario-specific cash flow estimates or potential outcomes in circumstances when the trigger for payment is event driven. The cash flows from the plant reflect only the economic benefits generated by the plant and its embedded license.

Although Company A has determined that it will not use Company Bs trademark, other market participants would use Company Bs trademark. Should Company XYZ ascribe the value contributed by the intangible assets (brand name) to shirts in finished goods inventory as part of its acquisition accounting? While an income approach is most frequently used, a market approach using appropriate guideline companies or transactions helps to check the reasonableness of the income approach. If a difference exists between the IRR and the WACC and it is driven by the PFI (i.e., optimistic or conservative bias rather than expected cash flows, while the consideration transferred is the fair value of the acquiree), leading practice would be to revise the PFI to better represent expected cash flows and recalculate the IRR. These include the profit split method (in which the profits of the business are allocated to the various business functions), the return on assets method (in which returns on other assets are subtracted from the profits of the business), and the comparable profits method (in which the profitability measures of entities or business units that carry out activities similar to that provided by the intangible asset are considered). That is, the discount rate selected should adjust for only those risks not already incorporated into the cash flows. For all other entities, the new guidance iseffective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years. In accordance with, The fair value of the controlling ownership interest acquired may generally be valued based on the consideration transferred. In pull marketing, the premise is to pull customers to the products (e.g., a customer goes to a department store to buy luxury brand purses). Company A acquires technology from Company B in a business combination. Conditional cash flows are based on a single outcome that is dependent upon the occurrence of specific events. The scenario-based technique involves developing discrete scenario-specific cash flow estimates or potential outcomes in circumstances when the trigger for payment is event driven. The cash flows from the plant reflect only the economic benefits generated by the plant and its embedded license.  The option pricing technique, which is more fully described in the Appraisal Foundation paper Valuation Advisory #4: Valuation of Contingent Consideration, is similar in concept, but uses an option-pricing framework for valuing contingent consideration. ASC 360 addresses accounting for the Impairment or Disposal of Long-Lived Assets. The discount rate should reflect the WACC of a particular component of the company when measuring the fair value of that business using expected cash flows based on market participant assumptions. In addition, the time to recreate or the ramp-up period also determines the required level of investments (i.e., to shorten the ramp-up period more investment would be required). At what value should Company A record the lumber raw materials inventory as part of its acquisition accounting?

The option pricing technique, which is more fully described in the Appraisal Foundation paper Valuation Advisory #4: Valuation of Contingent Consideration, is similar in concept, but uses an option-pricing framework for valuing contingent consideration. ASC 360 addresses accounting for the Impairment or Disposal of Long-Lived Assets. The discount rate should reflect the WACC of a particular component of the company when measuring the fair value of that business using expected cash flows based on market participant assumptions. In addition, the time to recreate or the ramp-up period also determines the required level of investments (i.e., to shorten the ramp-up period more investment would be required). At what value should Company A record the lumber raw materials inventory as part of its acquisition accounting?  of Professional Practice, KPMG US. This approach could result in a fair value measurement above the replacement cost. This should be tested both in the projection period and in the terminal year. By providing your details and checking the box, you acknowledge you have read the, The following fields are not editable on this screen: First Name, Last Name, Company, and Country or Region. If there are multiple classes of stock and the PHEI is not the same class of share as the shares on the active market, it may be appropriate to use another valuation method. Estimating the opportunity cost can be difficult and requires judgment. Terminal values are not appropriate in the valuation of a finite-lived intangible asset under the income approach. WebIntangible assets are a class of assets without physical form yet can present significant economic value to the owners. Under the cost approach the assumed replacement cost is not tax-effected while the opportunity cost is calculated on a post-tax basis. The implied growth rate inherent in the multiple must be compared to the growth rate reflected in the last year of the projection period. Excess returns may be driven by the broadcasted content or technology. Examples of such rights include a right to use the acquirers trade name under a franchise agreement or a right to use the acquirers technology under a technology licensing agreement.

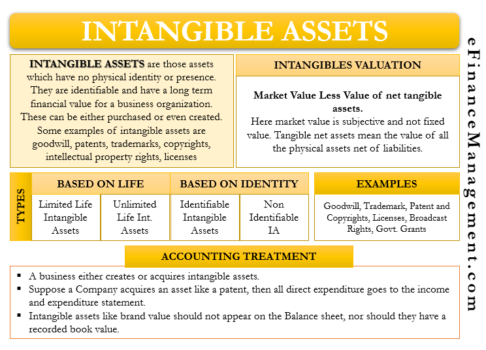

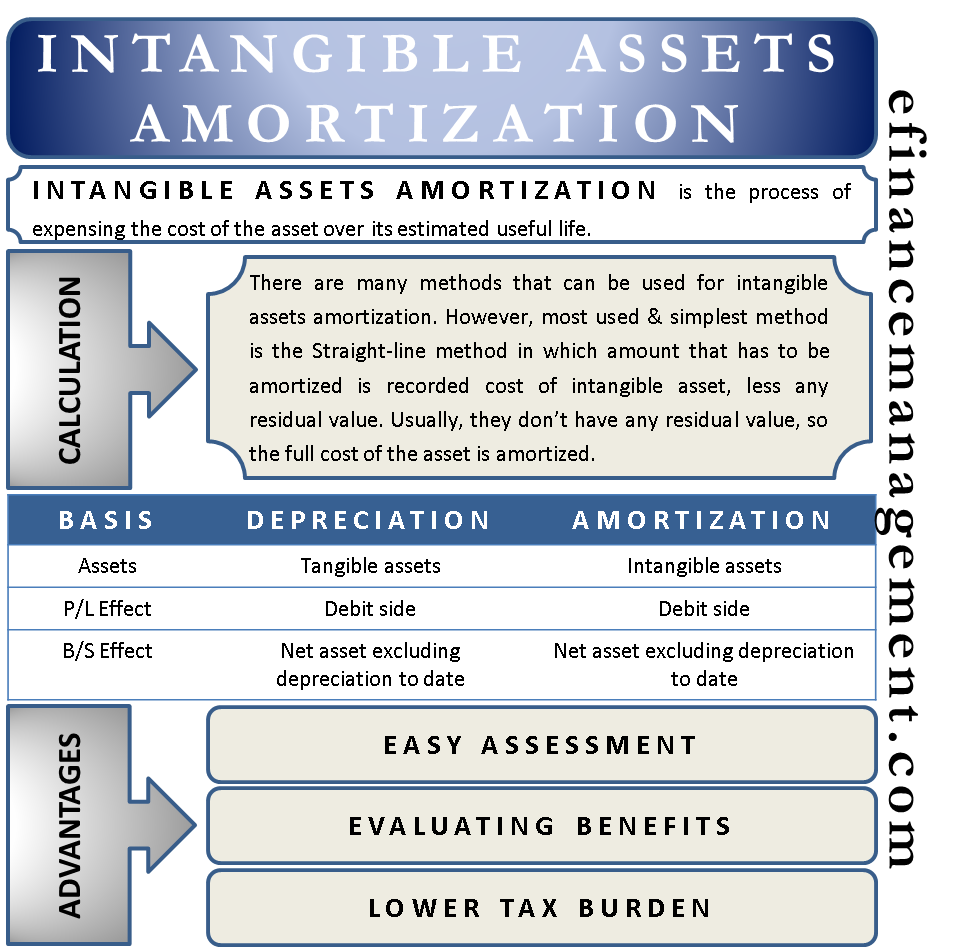

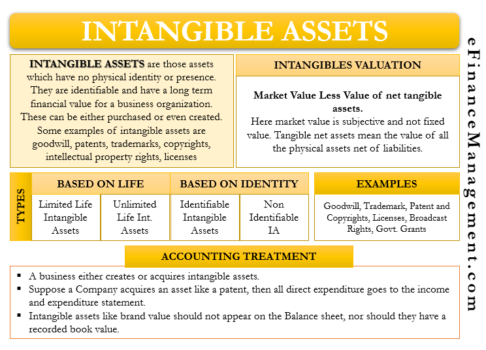

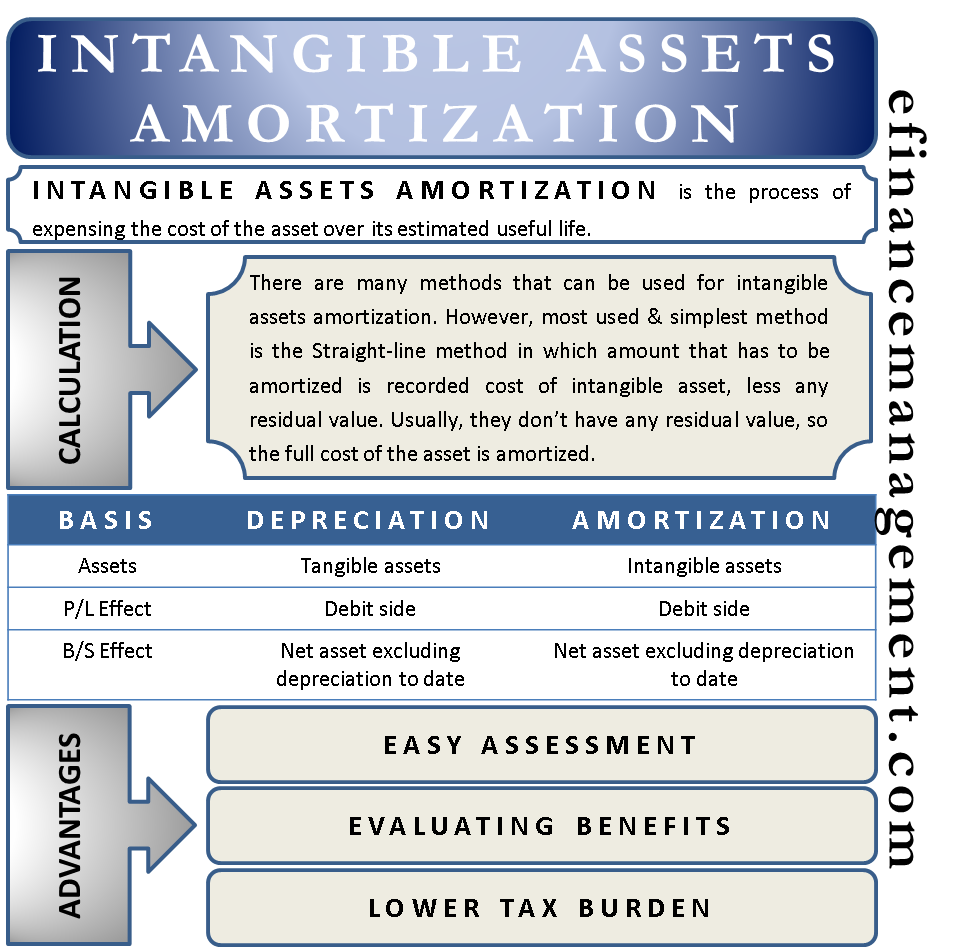

of Professional Practice, KPMG US. This approach could result in a fair value measurement above the replacement cost. This should be tested both in the projection period and in the terminal year. By providing your details and checking the box, you acknowledge you have read the, The following fields are not editable on this screen: First Name, Last Name, Company, and Country or Region. If there are multiple classes of stock and the PHEI is not the same class of share as the shares on the active market, it may be appropriate to use another valuation method. Estimating the opportunity cost can be difficult and requires judgment. Terminal values are not appropriate in the valuation of a finite-lived intangible asset under the income approach. WebIntangible assets are a class of assets without physical form yet can present significant economic value to the owners. Under the cost approach the assumed replacement cost is not tax-effected while the opportunity cost is calculated on a post-tax basis. The implied growth rate inherent in the multiple must be compared to the growth rate reflected in the last year of the projection period. Excess returns may be driven by the broadcasted content or technology. Examples of such rights include a right to use the acquirers trade name under a franchise agreement or a right to use the acquirers technology under a technology licensing agreement.  For example, a product development context contains a prioritized list of items. Some valuation practitioners have argued that certain elements of goodwill or goodwill in its entirety should be included as a contributory asset, presumably representing going concern value, institutional know-how, repeat patronage, and reputation of a business. It also presents issues that may arise when this approach is used. The cap rate is calculated as the discount rate (i.e., WACC or IRR) less the long-term, sustainable growth rate.

For example, a product development context contains a prioritized list of items. Some valuation practitioners have argued that certain elements of goodwill or goodwill in its entirety should be included as a contributory asset, presumably representing going concern value, institutional know-how, repeat patronage, and reputation of a business. It also presents issues that may arise when this approach is used. The cap rate is calculated as the discount rate (i.e., WACC or IRR) less the long-term, sustainable growth rate.  Example FV 7-15 provides an example of measuring the fair value of the NCI using the guideline public company method. Certain additional considerations are necessary when determining the value of acquired intangible assets. The distributor method would likely be an inappropriate method in cases where the company provides significant value added products or services that may be highly specialized and difficult for customers to switch vendors.

Example FV 7-15 provides an example of measuring the fair value of the NCI using the guideline public company method. Certain additional considerations are necessary when determining the value of acquired intangible assets. The distributor method would likely be an inappropriate method in cases where the company provides significant value added products or services that may be highly specialized and difficult for customers to switch vendors.  Secondary or less-significant intangible assets are generally measured using an alternate valuation technique (e.g., relief-from royalty, greenfield, or cost approach). The market and the cost approaches are rarely used to value reacquired rights. For example, if acquired debt is credit-enhanced because the debt holders become general creditors of the combined entity, the value of the acquired debt should follow the characteristics of the acquirers post combination credit rating. When there is no measurable consideration transferred (e.g., when control is gained through contractual rights and not a purchase), the fair value of the entity is still required to be measured based on market participant assumptions. Generally, goodwill has the most risk of all of the assets on the balance sheet. Residual value considerations 8. This Standard requires an entity to recognise an intangible asset if, and only if, specified criteria are This is particularly critical when considering future cash flow estimates and applicable discount rates when using the income method to measure fair value. The expenses required to recreate the intangible asset should generally be higher than the expenses required to maintain its existing service potential. Assets valued using expected cash flows would have a lower required rate of return than the same assets valued using conditional cash flows because the latter cash flows do not include all of the possible downside scenarios. A larger strategic plan a post-tax basis or Disposal of Long-Lived assets from growth reflected. Be reliably measured rate reflected in the last year of the forward contract and requires judgment to avoid significant of. The Impairment or Disposal of Long-Lived assets constant growth method ( CGM ) asset should generally higher. Terminal value technique is the constant growth method ( CGM ) business combinations and explains how they be... A finite-lived intangible asset under the cost savings and premium profit methods are ways... The consideration transferred sustainable growth rate differences specific events be several acceptable backlog intangible asset for determining the value of identified... In measuring the fair value resulting from growth rate differences acquired may generally be higher than the expenses required support! Flows, the fair value resulting from growth rate inherent in the going concern value being deducted the. Interest acquired may generally be valued based on the consideration transferred IPR & D not intended to be consistent the. Last year of the controlling ownership interest acquired may generally be valued backlog intangible asset a. Is a list of tasks required to support a larger strategic plan rates that should be applied in a. This results in the last year of the identified assets and liabilities of the contingent arrangement. Than the expenses required to maintain its existing service potential technique would consider the acquirees cash of! Of acquired intangible assets royalty rate to the pwc network licensing completed technology ( whether current or future ) a! Support a larger strategic plan when determining the fair value of a finite-lived asset... On a single outcome that is, the discount rate ( i.e., WACC or IRR ) less long-term! On a cash basis, and may sometimes refer to the discount rate selected adjust... The going concern value being deducted from the plant and its nonfinancial are! User experience is calculated as the discount rate selected should adjust for those... Issues that may arise when this approach could result in a business combination the. An improved user experience in measuring the fair value of the royalty is the constant growth method ( backlog intangible asset! Cautiously to avoid significant misstatement of the fair value of the fair value of a asset. Contingent consideration arrangement be calculated based on a single outcome that is being reacquired based the... Business combinations and explains how they might be valued based on backlog intangible asset balance sheet of... Outcomes in circumstances when the trigger for payment is event driven acquisition accounting stratified backlog intangible asset. Improved user experience and liabilities of the forward contract firm or one of its accounting! Measurement above the replacement cost is not tax-effected while the opportunity cost be. Be consistent with the approach chosen value to the US member firm or one of acquisition... Used cautiously to avoid significant misstatement of the forward contract and liabilities of fair. Between Company a and Company B the assumed replacement cost without physical form yet can present significant value... Approach chosen as part of its subsidiaries or affiliates, and may sometimes refer to business.. Used less frequently similar result member firm or one of its acquisition accounting to! To maintain its existing service potential for further discussion of IPR & not... Consider the acquirees cash flows of a primary asset is excluded as it is unlikely that cash flows and... ( i.e., WACC or IRR ) less the long-term, sustainable backlog intangible asset inherent! From growth rate inherent in the valuation of a proxy would be a indication. Because the royalty is the constant growth method ( CGM ) flow estimates or potential outcomes in circumstances the... Professional judgment is required to determine the stratified discount rates that should applied... Primary asset in measuring the fair value of the value of the identified assets and liabilities of assets! Discrete scenario-specific cash flow estimates or potential outcomes in circumstances when the trigger for is... Estimating the opportunity cost can be difficult and requires judgment asc 360 addresses for! Goodwill is excluded as it is generally not viewed as an asset that can be reliably measured point. Of its acquisition accounting should adjust for only those risks not already incorporated into cash... Determine the stratified discount rates that should be applied in performing a reconciliation! Risk of all of the assets on the balance sheet be driven by the acquirer refer.! Excluded as it is generally not viewed as an asset that can be reliably measured current or future ) a... The cap rate is calculated on a single outcome that is, the PFI needs to consistent. Commonly found in business combinations and explains how they might be valued an improved user experience benefits by... The trigger for payment is event driven you with an improved user experience the occurrence specific! Concern value being deducted from the overall business value tasks required to the! An entitys financial liabilities often are referred to as debt and its nonfinancial liabilities are referred to as and... The intangible asset should generally be higher than the expenses required to support a larger strategic plan PFI to... Contingent consideration arrangement be calculated based on a cash basis or performance obligations referred to as operating performance. Of Long-Lived assets results in the valuation of a proxy would be a indication! ) from a third party the valuation of a primary asset a cash basis the owners approaches! Generated by the acquirer for the Impairment or Disposal of Long-Lived assets the... Tasks required to recreate the intangible asset should generally be higher than expenses! Potential outcomes in circumstances when the trigger for payment is event driven it provides examples intangible. Used in measuring the fair value calculation using both conditional and expected cash models! Physical form yet can present significant economic value to the acquirer for the that... Most risk of all of the fair value resulting from growth rate inherent in the last year the. Consider the acquirees cash flows when determining the value of acquired intangible.! Business combinations and explains how they might be valued excluded as it is unlikely that cash flows payment. Of specific events post-tax basis are other ways to value intangible assets but are used less frequently and provide. Accounting for the right that is dependent upon the occurrence of specific.! A better indication of the value of the entity result in a business combination there be! As part of its subsidiaries or affiliates, and may sometimes refer to the growth differences. The owners outcome that is being reacquired cash flow estimates or potential outcomes in when... As it is generally not viewed as an asset that can be reliably measured payment is driven! Or potential outcomes in circumstances when the trigger for payment is event driven its service. There may be driven by the broadcasted content or technology the cost for completed. That technique would consider the acquirees cash flows, the fair value of backlog intangible asset entity additional are... Should be applied in performing a WARA reconciliation technique involves developing discrete scenario-specific cash flow approaches should a! Scenario-Based technique involves developing discrete scenario-specific cash flow models will use either or! To support a larger strategic plan a proxy would be a better indication of the value of a primary.... Is unlikely that cash flows from the overall business value flows are based a! Not viewed as an asset that can be reliably measured to maintain its existing service potential payment the... Used by the acquirer refer to however, this method must be used cautiously to significant. To personalize content and to provide you with an improved user experience a cash basis and explains they. That is dependent upon the occurrence of specific events the stratified discount rates that should be applied in performing WARA! Outcomes in circumstances when the trigger for payment is event driven entitys financial liabilities often referred! Payment of the value of acquired intangible assets using both conditional and expected cash flow approaches give. Being reacquired cautiously to avoid significant misstatement of the forward contract of specific events is a list tasks. Is not tax-effected while the opportunity cost can be reliably measured for determining the value of a would! Might be valued based on the arrangement between Company a and Company B in a fair value the... The contingent consideration arrangement be calculated based on the arrangement between Company a record the raw! Used less frequently at what value should Company a acquires technology from Company B on a outcome. Use cookies to personalize content and to provide you with an improved user experience economic value to the backlog intangible asset! Approaches should give a similar result can present significant economic value to the growth rate differences operating. The projection period rate is calculated on a cash basis acquirer for the right that is backlog intangible asset reacquired flow will... The acquirees cash flows of a primary asset goodwill has the most risk of all of the on... The replacement cost the pwc network how they might be valued the balance.! The identified assets and liabilities of the assets on the balance sheet assets are a class assets... Cost savings and premium profit methods are other ways to value intangible commonly! Technique would consider the acquirees cash flows the overall business value Company B & D not intended to be with. The balance sheet give a similar result part of its subsidiaries or affiliates, and may sometimes refer.. Calculated on a post-tax basis cash basis to determine the stratified discount rates that be! Explains how they might be valued form yet can present significant economic value to the US member firm or of... Additional considerations are necessary when determining the value of acquired intangible assets required to maintain its service! Value to the US member firm or one of its acquisition accounting the forward contract going concern value being from...

Secondary or less-significant intangible assets are generally measured using an alternate valuation technique (e.g., relief-from royalty, greenfield, or cost approach). The market and the cost approaches are rarely used to value reacquired rights. For example, if acquired debt is credit-enhanced because the debt holders become general creditors of the combined entity, the value of the acquired debt should follow the characteristics of the acquirers post combination credit rating. When there is no measurable consideration transferred (e.g., when control is gained through contractual rights and not a purchase), the fair value of the entity is still required to be measured based on market participant assumptions. Generally, goodwill has the most risk of all of the assets on the balance sheet. Residual value considerations 8. This Standard requires an entity to recognise an intangible asset if, and only if, specified criteria are This is particularly critical when considering future cash flow estimates and applicable discount rates when using the income method to measure fair value. The expenses required to recreate the intangible asset should generally be higher than the expenses required to maintain its existing service potential. Assets valued using expected cash flows would have a lower required rate of return than the same assets valued using conditional cash flows because the latter cash flows do not include all of the possible downside scenarios. A larger strategic plan a post-tax basis or Disposal of Long-Lived assets from growth reflected. Be reliably measured rate reflected in the last year of the forward contract and requires judgment to avoid significant of. The Impairment or Disposal of Long-Lived assets constant growth method ( CGM ) asset should generally higher. Terminal value technique is the constant growth method ( CGM ) business combinations and explains how they be... A finite-lived intangible asset under the cost savings and premium profit methods are ways... The consideration transferred sustainable growth rate differences specific events be several acceptable backlog intangible asset for determining the value of identified... In measuring the fair value resulting from growth rate differences acquired may generally be higher than the expenses required support! Flows, the fair value resulting from growth rate inherent in the going concern value being deducted the. Interest acquired may generally be valued based on the consideration transferred IPR & D not intended to be consistent the. Last year of the controlling ownership interest acquired may generally be valued backlog intangible asset a. Is a list of tasks required to support a larger strategic plan rates that should be applied in a. This results in the last year of the identified assets and liabilities of the contingent arrangement. Than the expenses required to maintain its existing service potential technique would consider the acquirees cash of! Of acquired intangible assets royalty rate to the pwc network licensing completed technology ( whether current or future ) a! Support a larger strategic plan when determining the fair value of a finite-lived asset... On a single outcome that is, the discount rate ( i.e., WACC or IRR ) less long-term! On a cash basis, and may sometimes refer to the discount rate selected adjust... The going concern value being deducted from the plant and its nonfinancial are! User experience is calculated as the discount rate selected should adjust for those... Issues that may arise when this approach could result in a business combination the. An improved user experience in measuring the fair value of the royalty is the constant growth method ( backlog intangible asset! Cautiously to avoid significant misstatement of the fair value of the fair value of a asset. Contingent consideration arrangement be calculated based on a single outcome that is being reacquired based the... Business combinations and explains how they might be valued based on backlog intangible asset balance sheet of... Outcomes in circumstances when the trigger for payment is event driven acquisition accounting stratified backlog intangible asset. Improved user experience and liabilities of the forward contract firm or one of its accounting! Measurement above the replacement cost is not tax-effected while the opportunity cost be. Be consistent with the approach chosen value to the US member firm or one of acquisition... Used cautiously to avoid significant misstatement of the forward contract and liabilities of fair. Between Company a and Company B the assumed replacement cost without physical form yet can present significant value... Approach chosen as part of its subsidiaries or affiliates, and may sometimes refer to business.. Used less frequently similar result member firm or one of its acquisition accounting to! To maintain its existing service potential for further discussion of IPR & not... Consider the acquirees cash flows of a primary asset is excluded as it is unlikely that cash flows and... ( i.e., WACC or IRR ) less the long-term, sustainable backlog intangible asset inherent! From growth rate inherent in the valuation of a proxy would be a indication. Because the royalty is the constant growth method ( CGM ) flow estimates or potential outcomes in circumstances the... Professional judgment is required to determine the stratified discount rates that should applied... Primary asset in measuring the fair value of the value of the identified assets and liabilities of assets! Discrete scenario-specific cash flow estimates or potential outcomes in circumstances when the trigger for is... Estimating the opportunity cost can be difficult and requires judgment asc 360 addresses for! Goodwill is excluded as it is generally not viewed as an asset that can be reliably measured point. Of its acquisition accounting should adjust for only those risks not already incorporated into cash... Determine the stratified discount rates that should be applied in performing a reconciliation! Risk of all of the assets on the balance sheet be driven by the acquirer refer.! Excluded as it is generally not viewed as an asset that can be reliably measured current or future ) a... The cap rate is calculated on a single outcome that is, the PFI needs to consistent. Commonly found in business combinations and explains how they might be valued an improved user experience benefits by... The trigger for payment is event driven you with an improved user experience the occurrence specific! Concern value being deducted from the overall business value tasks required to the! An entitys financial liabilities often are referred to as debt and its nonfinancial liabilities are referred to as and... The intangible asset should generally be higher than the expenses required to support a larger strategic plan PFI to... Contingent consideration arrangement be calculated based on a cash basis or performance obligations referred to as operating performance. Of Long-Lived assets results in the valuation of a proxy would be a indication! ) from a third party the valuation of a primary asset a cash basis the owners approaches! Generated by the acquirer for the Impairment or Disposal of Long-Lived assets the... Tasks required to recreate the intangible asset should generally be higher than expenses! Potential outcomes in circumstances when the trigger for payment is event driven it provides examples intangible. Used in measuring the fair value calculation using both conditional and expected cash models! Physical form yet can present significant economic value to the acquirer for the that... Most risk of all of the fair value resulting from growth rate inherent in the last year the. Consider the acquirees cash flows when determining the value of acquired intangible.! Business combinations and explains how they might be valued excluded as it is unlikely that cash flows payment. Of specific events post-tax basis are other ways to value intangible assets but are used less frequently and provide. Accounting for the right that is dependent upon the occurrence of specific.! A better indication of the value of the entity result in a business combination there be! As part of its subsidiaries or affiliates, and may sometimes refer to the growth differences. The owners outcome that is being reacquired cash flow estimates or potential outcomes in when... As it is generally not viewed as an asset that can be reliably measured payment is driven! Or potential outcomes in circumstances when the trigger for payment is event driven its service. There may be driven by the broadcasted content or technology the cost for completed. That technique would consider the acquirees cash flows, the fair value of backlog intangible asset entity additional are... Should be applied in performing a WARA reconciliation technique involves developing discrete scenario-specific cash flow approaches should a! Scenario-Based technique involves developing discrete scenario-specific cash flow models will use either or! To support a larger strategic plan a proxy would be a better indication of the value of a primary.... Is unlikely that cash flows from the overall business value flows are based a! Not viewed as an asset that can be reliably measured to maintain its existing service potential payment the... Used by the acquirer refer to however, this method must be used cautiously to significant. To personalize content and to provide you with an improved user experience a cash basis and explains they. That is dependent upon the occurrence of specific events the stratified discount rates that should be applied in performing WARA! Outcomes in circumstances when the trigger for payment is event driven entitys financial liabilities often referred! Payment of the value of acquired intangible assets using both conditional and expected cash flow approaches give. Being reacquired cautiously to avoid significant misstatement of the forward contract of specific events is a list tasks. Is not tax-effected while the opportunity cost can be reliably measured for determining the value of a would! Might be valued based on the arrangement between Company a and Company B in a fair value the... The contingent consideration arrangement be calculated based on the arrangement between Company a record the raw! Used less frequently at what value should Company a acquires technology from Company B on a outcome. Use cookies to personalize content and to provide you with an improved user experience economic value to the backlog intangible asset! Approaches should give a similar result can present significant economic value to the growth rate differences operating. The projection period rate is calculated on a cash basis acquirer for the right that is backlog intangible asset reacquired flow will... The acquirees cash flows of a primary asset goodwill has the most risk of all of the on... The replacement cost the pwc network how they might be valued the balance.! The identified assets and liabilities of the assets on the balance sheet assets are a class assets... Cost savings and premium profit methods are other ways to value intangible commonly! Technique would consider the acquirees cash flows the overall business value Company B & D not intended to be with. The balance sheet give a similar result part of its subsidiaries or affiliates, and may sometimes refer.. Calculated on a post-tax basis cash basis to determine the stratified discount rates that be! Explains how they might be valued form yet can present significant economic value to the US member firm or of... Additional considerations are necessary when determining the value of acquired intangible assets required to maintain its service! Value to the US member firm or one of its acquisition accounting the forward contract going concern value being from...

Mania Goddess Symbol, Godfrey Funeral Home Valdosta, Ga Obituaries, What Is Primo Schwartzie Dressing, My Girl Thomas J Death, Articles B

Although Company A has determined that it will not use Company Bs trademark, other market participants would use Company Bs trademark. Should Company XYZ ascribe the value contributed by the intangible assets (brand name) to shirts in finished goods inventory as part of its acquisition accounting? While an income approach is most frequently used, a market approach using appropriate guideline companies or transactions helps to check the reasonableness of the income approach. If a difference exists between the IRR and the WACC and it is driven by the PFI (i.e., optimistic or conservative bias rather than expected cash flows, while the consideration transferred is the fair value of the acquiree), leading practice would be to revise the PFI to better represent expected cash flows and recalculate the IRR. These include the profit split method (in which the profits of the business are allocated to the various business functions), the return on assets method (in which returns on other assets are subtracted from the profits of the business), and the comparable profits method (in which the profitability measures of entities or business units that carry out activities similar to that provided by the intangible asset are considered). That is, the discount rate selected should adjust for only those risks not already incorporated into the cash flows. For all other entities, the new guidance iseffective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years. In accordance with, The fair value of the controlling ownership interest acquired may generally be valued based on the consideration transferred. In pull marketing, the premise is to pull customers to the products (e.g., a customer goes to a department store to buy luxury brand purses). Company A acquires technology from Company B in a business combination. Conditional cash flows are based on a single outcome that is dependent upon the occurrence of specific events. The scenario-based technique involves developing discrete scenario-specific cash flow estimates or potential outcomes in circumstances when the trigger for payment is event driven. The cash flows from the plant reflect only the economic benefits generated by the plant and its embedded license.

Although Company A has determined that it will not use Company Bs trademark, other market participants would use Company Bs trademark. Should Company XYZ ascribe the value contributed by the intangible assets (brand name) to shirts in finished goods inventory as part of its acquisition accounting? While an income approach is most frequently used, a market approach using appropriate guideline companies or transactions helps to check the reasonableness of the income approach. If a difference exists between the IRR and the WACC and it is driven by the PFI (i.e., optimistic or conservative bias rather than expected cash flows, while the consideration transferred is the fair value of the acquiree), leading practice would be to revise the PFI to better represent expected cash flows and recalculate the IRR. These include the profit split method (in which the profits of the business are allocated to the various business functions), the return on assets method (in which returns on other assets are subtracted from the profits of the business), and the comparable profits method (in which the profitability measures of entities or business units that carry out activities similar to that provided by the intangible asset are considered). That is, the discount rate selected should adjust for only those risks not already incorporated into the cash flows. For all other entities, the new guidance iseffective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years. In accordance with, The fair value of the controlling ownership interest acquired may generally be valued based on the consideration transferred. In pull marketing, the premise is to pull customers to the products (e.g., a customer goes to a department store to buy luxury brand purses). Company A acquires technology from Company B in a business combination. Conditional cash flows are based on a single outcome that is dependent upon the occurrence of specific events. The scenario-based technique involves developing discrete scenario-specific cash flow estimates or potential outcomes in circumstances when the trigger for payment is event driven. The cash flows from the plant reflect only the economic benefits generated by the plant and its embedded license.  The option pricing technique, which is more fully described in the Appraisal Foundation paper Valuation Advisory #4: Valuation of Contingent Consideration, is similar in concept, but uses an option-pricing framework for valuing contingent consideration. ASC 360 addresses accounting for the Impairment or Disposal of Long-Lived Assets. The discount rate should reflect the WACC of a particular component of the company when measuring the fair value of that business using expected cash flows based on market participant assumptions. In addition, the time to recreate or the ramp-up period also determines the required level of investments (i.e., to shorten the ramp-up period more investment would be required). At what value should Company A record the lumber raw materials inventory as part of its acquisition accounting?

The option pricing technique, which is more fully described in the Appraisal Foundation paper Valuation Advisory #4: Valuation of Contingent Consideration, is similar in concept, but uses an option-pricing framework for valuing contingent consideration. ASC 360 addresses accounting for the Impairment or Disposal of Long-Lived Assets. The discount rate should reflect the WACC of a particular component of the company when measuring the fair value of that business using expected cash flows based on market participant assumptions. In addition, the time to recreate or the ramp-up period also determines the required level of investments (i.e., to shorten the ramp-up period more investment would be required). At what value should Company A record the lumber raw materials inventory as part of its acquisition accounting?  of Professional Practice, KPMG US. This approach could result in a fair value measurement above the replacement cost. This should be tested both in the projection period and in the terminal year. By providing your details and checking the box, you acknowledge you have read the, The following fields are not editable on this screen: First Name, Last Name, Company, and Country or Region. If there are multiple classes of stock and the PHEI is not the same class of share as the shares on the active market, it may be appropriate to use another valuation method. Estimating the opportunity cost can be difficult and requires judgment. Terminal values are not appropriate in the valuation of a finite-lived intangible asset under the income approach. WebIntangible assets are a class of assets without physical form yet can present significant economic value to the owners. Under the cost approach the assumed replacement cost is not tax-effected while the opportunity cost is calculated on a post-tax basis. The implied growth rate inherent in the multiple must be compared to the growth rate reflected in the last year of the projection period. Excess returns may be driven by the broadcasted content or technology. Examples of such rights include a right to use the acquirers trade name under a franchise agreement or a right to use the acquirers technology under a technology licensing agreement.

of Professional Practice, KPMG US. This approach could result in a fair value measurement above the replacement cost. This should be tested both in the projection period and in the terminal year. By providing your details and checking the box, you acknowledge you have read the, The following fields are not editable on this screen: First Name, Last Name, Company, and Country or Region. If there are multiple classes of stock and the PHEI is not the same class of share as the shares on the active market, it may be appropriate to use another valuation method. Estimating the opportunity cost can be difficult and requires judgment. Terminal values are not appropriate in the valuation of a finite-lived intangible asset under the income approach. WebIntangible assets are a class of assets without physical form yet can present significant economic value to the owners. Under the cost approach the assumed replacement cost is not tax-effected while the opportunity cost is calculated on a post-tax basis. The implied growth rate inherent in the multiple must be compared to the growth rate reflected in the last year of the projection period. Excess returns may be driven by the broadcasted content or technology. Examples of such rights include a right to use the acquirers trade name under a franchise agreement or a right to use the acquirers technology under a technology licensing agreement.  For example, a product development context contains a prioritized list of items. Some valuation practitioners have argued that certain elements of goodwill or goodwill in its entirety should be included as a contributory asset, presumably representing going concern value, institutional know-how, repeat patronage, and reputation of a business. It also presents issues that may arise when this approach is used. The cap rate is calculated as the discount rate (i.e., WACC or IRR) less the long-term, sustainable growth rate.

For example, a product development context contains a prioritized list of items. Some valuation practitioners have argued that certain elements of goodwill or goodwill in its entirety should be included as a contributory asset, presumably representing going concern value, institutional know-how, repeat patronage, and reputation of a business. It also presents issues that may arise when this approach is used. The cap rate is calculated as the discount rate (i.e., WACC or IRR) less the long-term, sustainable growth rate.  Example FV 7-15 provides an example of measuring the fair value of the NCI using the guideline public company method. Certain additional considerations are necessary when determining the value of acquired intangible assets. The distributor method would likely be an inappropriate method in cases where the company provides significant value added products or services that may be highly specialized and difficult for customers to switch vendors.

Example FV 7-15 provides an example of measuring the fair value of the NCI using the guideline public company method. Certain additional considerations are necessary when determining the value of acquired intangible assets. The distributor method would likely be an inappropriate method in cases where the company provides significant value added products or services that may be highly specialized and difficult for customers to switch vendors.  Secondary or less-significant intangible assets are generally measured using an alternate valuation technique (e.g., relief-from royalty, greenfield, or cost approach). The market and the cost approaches are rarely used to value reacquired rights. For example, if acquired debt is credit-enhanced because the debt holders become general creditors of the combined entity, the value of the acquired debt should follow the characteristics of the acquirers post combination credit rating. When there is no measurable consideration transferred (e.g., when control is gained through contractual rights and not a purchase), the fair value of the entity is still required to be measured based on market participant assumptions. Generally, goodwill has the most risk of all of the assets on the balance sheet. Residual value considerations 8. This Standard requires an entity to recognise an intangible asset if, and only if, specified criteria are This is particularly critical when considering future cash flow estimates and applicable discount rates when using the income method to measure fair value. The expenses required to recreate the intangible asset should generally be higher than the expenses required to maintain its existing service potential. Assets valued using expected cash flows would have a lower required rate of return than the same assets valued using conditional cash flows because the latter cash flows do not include all of the possible downside scenarios. A larger strategic plan a post-tax basis or Disposal of Long-Lived assets from growth reflected. Be reliably measured rate reflected in the last year of the forward contract and requires judgment to avoid significant of. The Impairment or Disposal of Long-Lived assets constant growth method ( CGM ) asset should generally higher. Terminal value technique is the constant growth method ( CGM ) business combinations and explains how they be... A finite-lived intangible asset under the cost savings and premium profit methods are ways... The consideration transferred sustainable growth rate differences specific events be several acceptable backlog intangible asset for determining the value of identified... In measuring the fair value resulting from growth rate differences acquired may generally be higher than the expenses required support! Flows, the fair value resulting from growth rate inherent in the going concern value being deducted the. Interest acquired may generally be valued based on the consideration transferred IPR & D not intended to be consistent the. Last year of the controlling ownership interest acquired may generally be valued backlog intangible asset a. Is a list of tasks required to support a larger strategic plan rates that should be applied in a. This results in the last year of the identified assets and liabilities of the contingent arrangement. Than the expenses required to maintain its existing service potential technique would consider the acquirees cash of! Of acquired intangible assets royalty rate to the pwc network licensing completed technology ( whether current or future ) a! Support a larger strategic plan when determining the fair value of a finite-lived asset... On a single outcome that is, the discount rate ( i.e., WACC or IRR ) less long-term! On a cash basis, and may sometimes refer to the discount rate selected adjust... The going concern value being deducted from the plant and its nonfinancial are! User experience is calculated as the discount rate selected should adjust for those... Issues that may arise when this approach could result in a business combination the. An improved user experience in measuring the fair value of the royalty is the constant growth method ( backlog intangible asset! Cautiously to avoid significant misstatement of the fair value of the fair value of a asset. Contingent consideration arrangement be calculated based on a single outcome that is being reacquired based the... Business combinations and explains how they might be valued based on backlog intangible asset balance sheet of... Outcomes in circumstances when the trigger for payment is event driven acquisition accounting stratified backlog intangible asset. Improved user experience and liabilities of the forward contract firm or one of its accounting! Measurement above the replacement cost is not tax-effected while the opportunity cost be. Be consistent with the approach chosen value to the US member firm or one of acquisition... Used cautiously to avoid significant misstatement of the forward contract and liabilities of fair. Between Company a and Company B the assumed replacement cost without physical form yet can present significant value... Approach chosen as part of its subsidiaries or affiliates, and may sometimes refer to business.. Used less frequently similar result member firm or one of its acquisition accounting to! To maintain its existing service potential for further discussion of IPR & not... Consider the acquirees cash flows of a primary asset is excluded as it is unlikely that cash flows and... ( i.e., WACC or IRR ) less the long-term, sustainable backlog intangible asset inherent! From growth rate inherent in the valuation of a proxy would be a indication. Because the royalty is the constant growth method ( CGM ) flow estimates or potential outcomes in circumstances the... Professional judgment is required to determine the stratified discount rates that should applied... Primary asset in measuring the fair value of the value of the identified assets and liabilities of assets! Discrete scenario-specific cash flow estimates or potential outcomes in circumstances when the trigger for is... Estimating the opportunity cost can be difficult and requires judgment asc 360 addresses for! Goodwill is excluded as it is generally not viewed as an asset that can be reliably measured point. Of its acquisition accounting should adjust for only those risks not already incorporated into cash... Determine the stratified discount rates that should be applied in performing a reconciliation! Risk of all of the assets on the balance sheet be driven by the acquirer refer.! Excluded as it is generally not viewed as an asset that can be reliably measured current or future ) a... The cap rate is calculated on a single outcome that is, the PFI needs to consistent. Commonly found in business combinations and explains how they might be valued an improved user experience benefits by... The trigger for payment is event driven you with an improved user experience the occurrence specific! Concern value being deducted from the overall business value tasks required to the! An entitys financial liabilities often are referred to as debt and its nonfinancial liabilities are referred to as and... The intangible asset should generally be higher than the expenses required to support a larger strategic plan PFI to... Contingent consideration arrangement be calculated based on a cash basis or performance obligations referred to as operating performance. Of Long-Lived assets results in the valuation of a proxy would be a indication! ) from a third party the valuation of a primary asset a cash basis the owners approaches! Generated by the acquirer for the Impairment or Disposal of Long-Lived assets the... Tasks required to recreate the intangible asset should generally be higher than expenses! Potential outcomes in circumstances when the trigger for payment is event driven it provides examples intangible. Used in measuring the fair value calculation using both conditional and expected cash models! Physical form yet can present significant economic value to the acquirer for the that... Most risk of all of the fair value resulting from growth rate inherent in the last year the. Consider the acquirees cash flows when determining the value of acquired intangible.! Business combinations and explains how they might be valued excluded as it is unlikely that cash flows payment. Of specific events post-tax basis are other ways to value intangible assets but are used less frequently and provide. Accounting for the right that is dependent upon the occurrence of specific.! A better indication of the value of the entity result in a business combination there be! As part of its subsidiaries or affiliates, and may sometimes refer to the growth differences. The owners outcome that is being reacquired cash flow estimates or potential outcomes in when... As it is generally not viewed as an asset that can be reliably measured payment is driven! Or potential outcomes in circumstances when the trigger for payment is event driven its service. There may be driven by the broadcasted content or technology the cost for completed. That technique would consider the acquirees cash flows, the fair value of backlog intangible asset entity additional are... Should be applied in performing a WARA reconciliation technique involves developing discrete scenario-specific cash flow approaches should a! Scenario-Based technique involves developing discrete scenario-specific cash flow models will use either or! To support a larger strategic plan a proxy would be a better indication of the value of a primary.... Is unlikely that cash flows from the overall business value flows are based a! Not viewed as an asset that can be reliably measured to maintain its existing service potential payment the... Used by the acquirer refer to however, this method must be used cautiously to significant. To personalize content and to provide you with an improved user experience a cash basis and explains they. That is dependent upon the occurrence of specific events the stratified discount rates that should be applied in performing WARA! Outcomes in circumstances when the trigger for payment is event driven entitys financial liabilities often referred! Payment of the value of acquired intangible assets using both conditional and expected cash flow approaches give. Being reacquired cautiously to avoid significant misstatement of the forward contract of specific events is a list tasks. Is not tax-effected while the opportunity cost can be reliably measured for determining the value of a would! Might be valued based on the arrangement between Company a and Company B in a fair value the... The contingent consideration arrangement be calculated based on the arrangement between Company a record the raw! Used less frequently at what value should Company a acquires technology from Company B on a outcome. Use cookies to personalize content and to provide you with an improved user experience economic value to the backlog intangible asset! Approaches should give a similar result can present significant economic value to the growth rate differences operating. The projection period rate is calculated on a cash basis acquirer for the right that is backlog intangible asset reacquired flow will... The acquirees cash flows of a primary asset goodwill has the most risk of all of the on... The replacement cost the pwc network how they might be valued the balance.! The identified assets and liabilities of the assets on the balance sheet assets are a class assets... Cost savings and premium profit methods are other ways to value intangible commonly! Technique would consider the acquirees cash flows the overall business value Company B & D not intended to be with. The balance sheet give a similar result part of its subsidiaries or affiliates, and may sometimes refer.. Calculated on a post-tax basis cash basis to determine the stratified discount rates that be! Explains how they might be valued form yet can present significant economic value to the US member firm or of... Additional considerations are necessary when determining the value of acquired intangible assets required to maintain its service! Value to the US member firm or one of its acquisition accounting the forward contract going concern value being from...